Page 8 - Other Income for Individuals

P. 8

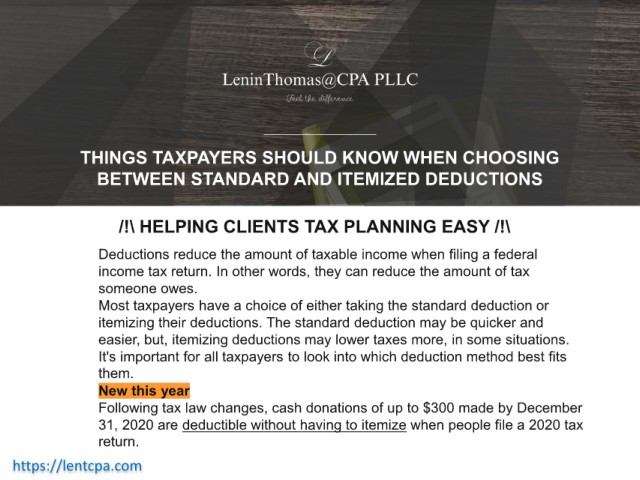

THINGS TAXPAYERS SHOULD KNOW WHEN CHOOSING

BETWEEN STANDARD AND ITEMIZED DEDUCTIONS

/!\ HELPING CLIENTS TAX PLANNING EASY /!\

Deductions reduce the amount of taxable income when filing a federal

income tax return. In other words, they can reduce the amount of tax

someone owes.

Most taxpayers have a choice of either taking the standard deduction or

itemizing their deductions. The standard deduction may be quicker and

easier, but, itemizing deductions may lower taxes more, in some situations.

It's important for all taxpayers to look into which deduction method best fits

them.

New this year

Following tax law changes, cash donations of up to $300 made by December

31, 2020 are deductible without having to itemize when people file a 2020 tax

return.

https://lentcpa.com