Page 88 - Other Income for Individuals

P. 88

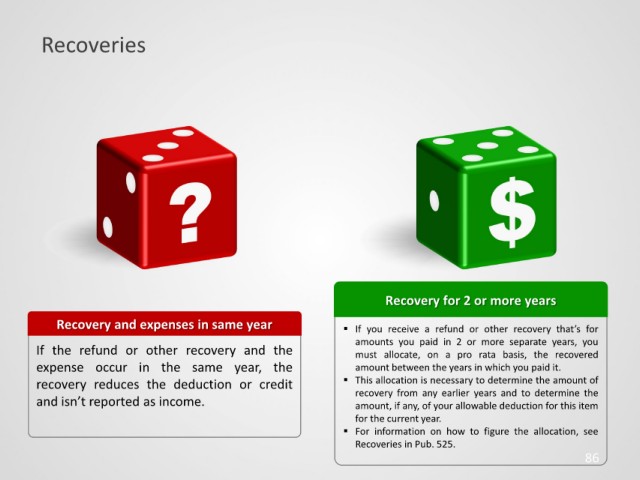

Recoveries

Recovery for 2 or more years

Recovery and expenses in same year If you receive a refund or other recovery that’s for

amounts you paid in 2 or more separate years, you

If the refund or other recovery and the must allocate, on a pro rata basis, the recovered

expense occur in the same year, the amount between the years in which you paid it.

recovery reduces the deduction or credit This allocation is necessary to determine the amount of

and isn’t reported as income. recovery from any earlier years and to determine the

amount, if any, of your allowable deduction for this item

for the current year.

For information on how to figure the allocation, see

Recoveries in Pub. 525.

86