Page 20 - Tax Withholding Estimator FAQ's

P. 20

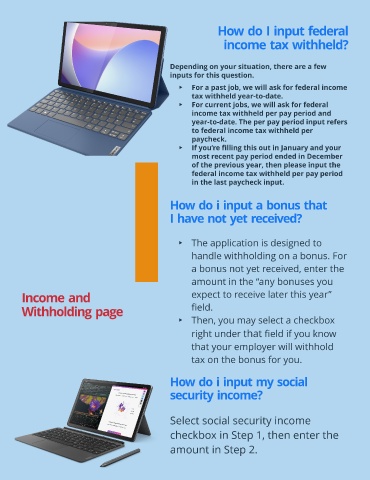

How do I input federal

income tax withheld?

Depending on your sit uat ion, t here are a few

input s for t his quest ion.

- For a past job, we will ask for federal income

t ax wit hheld year-t o-dat e.

- For current jobs, we will ask for federal

income t ax wit hheld per pay period and

year-t o-dat e. The per pay period input refers

t o federal income t ax wit hheld per

paycheck.

- If you?e filling t his out in January and your

r

most recent pay period ended in December

of t he previous year, t hen please input t he

federal income t ax wit hheld per pay period

in t he last paycheck input .

How do i input a bonus that

I have not yet received?

- The application is designed to

handle withholding on a bonus. For

a bonus not yet received, enter the

amount in the ?any bonuses you

Income and expect to receive later this year?

Withholding page field.

- Then, you may select a checkbox

right under that field if you know

that your employer will withhold

tax on the bonus for you.

How do i input my social

security income?

Select social security income

checkbox in Step 1, then enter the

amount in Step 2.