Page 286 - Auditing Standards

P. 286

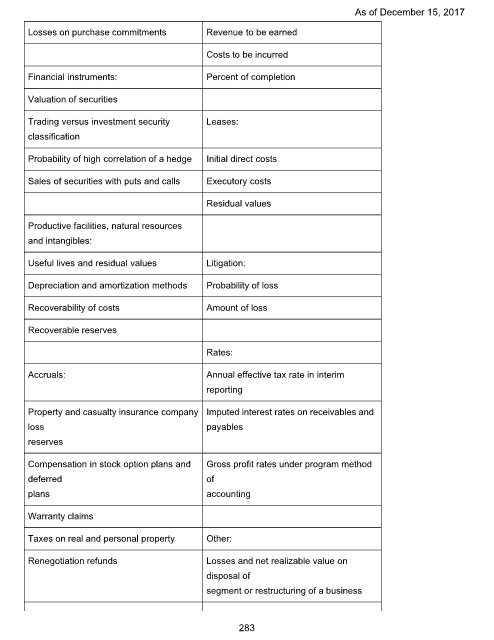

As of December 15, 2017

Losses on purchase commitments Revenue to be earned

Costs to be incurred

Financial instruments: Percent of completion

Valuation of securities

Trading versus investment security Leases:

classification

Probability of high correlation of a hedge Initial direct costs

Sales of securities with puts and calls Executory costs

Residual values

Productive facilities, natural resources

and intangibles:

Useful lives and residual values Litigation:

Depreciation and amortization methods Probability of loss

Recoverability of costs Amount of loss

Recoverable reserves

Rates:

Accruals: Annual effective tax rate in interim

reporting

Property and casualty insurance company Imputed interest rates on receivables and

loss payables

reserves

Compensation in stock option plans and Gross profit rates under program method

deferred of

plans accounting

Warranty claims

Taxes on real and personal property Other:

Renegotiation refunds Losses and net realizable value on

disposal of

segment or restructuring of a business

283