Page 608 - Auditing Standards

P. 608

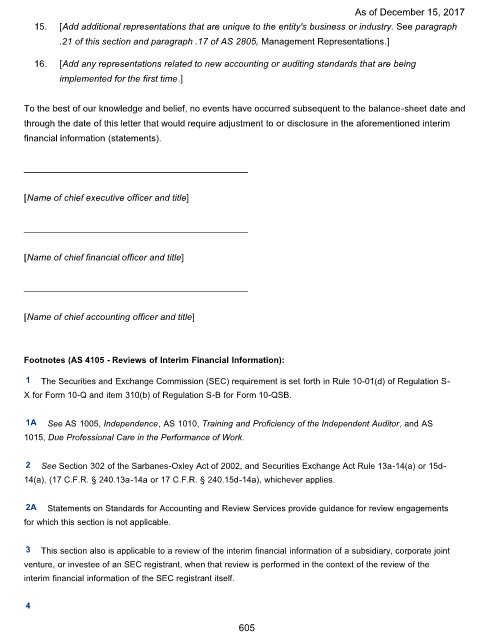

As of December 15, 2017

15. [Add additional representations that are unique to the entity's business or industry. See paragraph

.21 of this section and paragraph .17 of AS 2805, Management Representations.]

16. [Add any representations related to new accounting or auditing standards that are being

implemented for the first time.]

To the best of our knowledge and belief, no events have occurred subsequent to the balance-sheet date and

through the date of this letter that would require adjustment to or disclosure in the aforementioned interim

financial information (statements).

____________________________________________

[Name of chief executive officer and title]

____________________________________________

[Name of chief financial officer and title]

____________________________________________

[Name of chief accounting officer and title]

Footnotes (AS 4105 - Reviews of Interim Financial Information):

1 The Securities and Exchange Commission (SEC) requirement is set forth in Rule 10-01(d) of Regulation S-

X for Form 10-Q and item 310(b) of Regulation S-B for Form 10-QSB.

1A See AS 1005, Independence, AS 1010, Training and Proficiency of the Independent Auditor, and AS

1015, Due Professional Care in the Performance of Work.

2 See Section 302 of the Sarbanes-Oxley Act of 2002, and Securities Exchange Act Rule 13a-14(a) or 15d-

14(a), (17 C.F.R. § 240.13a-14a or 17 C.F.R. § 240.15d-14a), whichever applies.

2A Statements on Standards for Accounting and Review Services provide guidance for review engagements

for which this section is not applicable.

3 This section also is applicable to a review of the interim financial information of a subsidiary, corporate joint

venture, or investee of an SEC registrant, when that review is performed in the context of the review of the

interim financial information of the SEC registrant itself.

4

605