Page 203 - ACFE Fraud Reports 2009_2020

P. 203

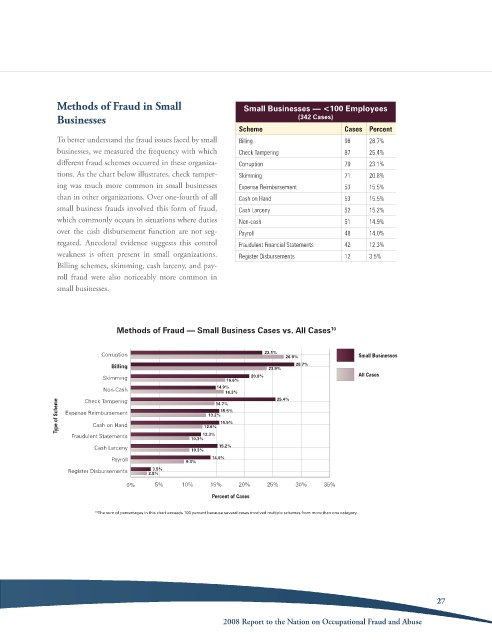

Methods of Fraud in Small Small Businesses — <100 Employees

Businesses (342 Cases)

Scheme Cases Percent

to better understand the fraud issues faced by small Billing 98 28.7%

businesses, we measured the frequency with which Check Tampering 87 25.4%

different fraud schemes occurred in these organiza- Corruption 79 23.1%

tions. as the chart below illustrates, check tamper- Skimming 71 20.8%

ing was much more common in small businesses Expense Reimbursement 53 15.5%

than in other organizations. over one-fourth of all Cash on Hand 53 15.5%

small business frauds involved this form of fraud, Cash Larceny 52 15.2%

which commonly occurs in situations where duties Non-cash 51 14.9%

over the cash disbursement function are not seg- Payroll 48 14.0%

regated. anecdotal evidence suggests this control Fraudulent Financial Statements 42 12.3%

weakness is often present in small organizations. Register Disbursements 12 3.5%

billing schemes, skimming, cash larceny, and pay-

roll fraud were also noticeably more common in

small businesses.

Methods of Fraud — Small Business Cases vs. All Cases 10

Corruption 23.1% 26.9% Small Businesses

Billing 23.9% 28.7%

Skimming 16.6% 20.8% All Cases

Non-Cash 14.9% 25.4%

16.3%

Check Tampering

Type of Scheme Expense Reimbursement 12.6% 14.7%

15.5%

13.2%

15.5%

Cash on Hand

Fraudulent Statements 10.3% 12.3%

Cash Larceny 10.3% 15.2%

Payroll 9.3% 14.0%

3.5%

Register Disbursements 2.8%

0% 5% 10% 15% 20% 25% 30% 35%

Percent of Cases

10 The sum of percentages in this chart exceeds 100 percent because several cases involved multiple schemes from more than one category.

27

2008 Report to the Nation on occupational Fraud and abuse