Page 22 - 2021 IRS Tax Calendar - Handbook

P. 22

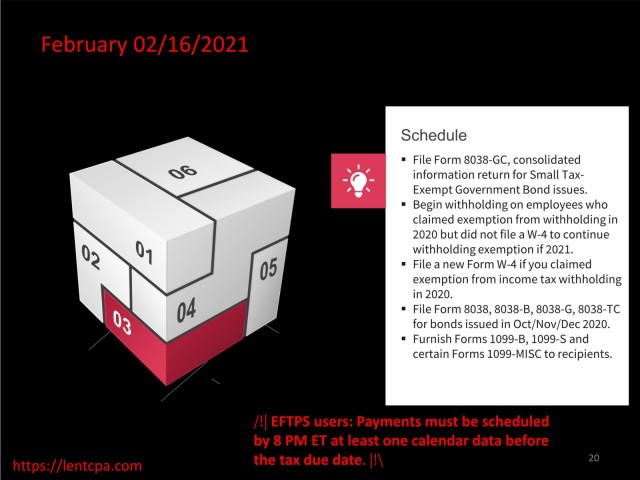

February 02/16/2021

Schedule

File Form 8038-GC, consolidated

information return for Small Tax-

Exempt Government Bond issues.

Begin withholding on employees who

claimed exemption from withholding in

2020 but did not file a W-4 to continue

withholding exemption if 2021.

File a new Form W-4 if you claimed

exemption from income tax withholding

in 2020.

File Form 8038, 8038-B, 8038-G, 8038-TC

for bonds issued in Oct/Nov/Dec 2020.

Furnish Forms 1099-B, 1099-S and

certain Forms 1099-MISC to recipients.

/!| EFTPS users: Payments must be scheduled

by 8 PM ET at least one calendar data before

https://lentcpa.com the tax due date. |!\ 20