Page 49 - 2021 IRS Tax Calendar - Handbook

P. 49

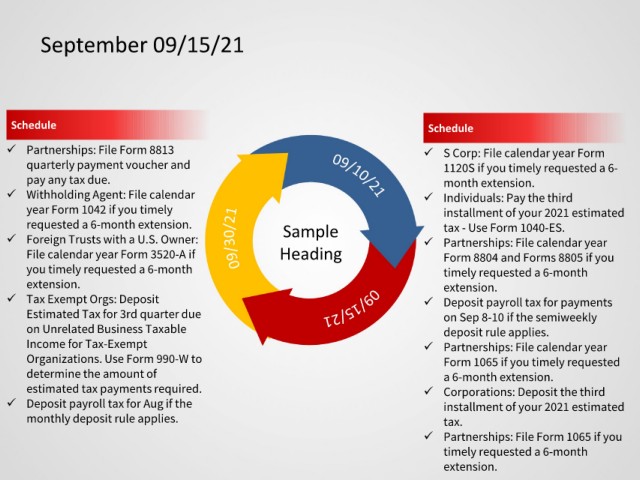

September 09/15/21

Schedule Schedule

Partnerships: File Form 8813 S Corp: File calendar year Form

quarterly payment voucher and 1120S if you timely requested a 6-

pay any tax due. month extension.

Withholding Agent: File calendar Individuals: Pay the third

year Form 1042 if you timely installment of your 2021 estimated

requested a 6-month extension. Sample tax - Use Form 1040-ES.

Foreign Trusts with a U.S. Owner: Partnerships: File calendar year

File calendar year Form 3520-A if Heading Form 8804 and Forms 8805 if you

you timely requested a 6-month timely requested a 6-month

extension. extension.

Tax Exempt Orgs: Deposit Deposit payroll tax for payments

Estimated Tax for 3rd quarter due on Sep 8-10 if the semiweekly

on Unrelated Business Taxable deposit rule applies.

Income for Tax-Exempt Partnerships: File calendar year

Organizations. Use Form 990-W to Form 1065 if you timely requested

determine the amount of a 6-month extension.

estimated tax payments required. Corporations: Deposit the third

Deposit payroll tax for Aug if the installment of your 2021 estimated

monthly deposit rule applies. tax.

Partnerships: File Form 1065 if you

timely requested a 6-month

extension.