Page 16 - 2020 Taxes Quick Guide

P. 16

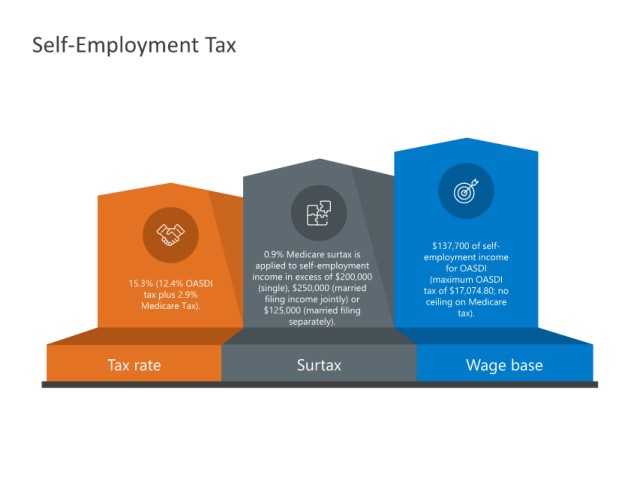

Self-Employment Tax

$137,700 of self-

0.9% Medicare surtax is employment income

applied to self-employment for OASDI

income in excess of $200,000 (maximum OASDI

15.3% (12.4% OASDI (single), $250,000 (married

tax plus 2.9% filing income jointly) or tax of $17,074.80; no

Medicare Tax). ceiling on Medicare

$125,000 (married filing tax).

separately).

Tax rate Surtax Wage base