Page 24 - Texas Franchise Tax Handbook

P. 24

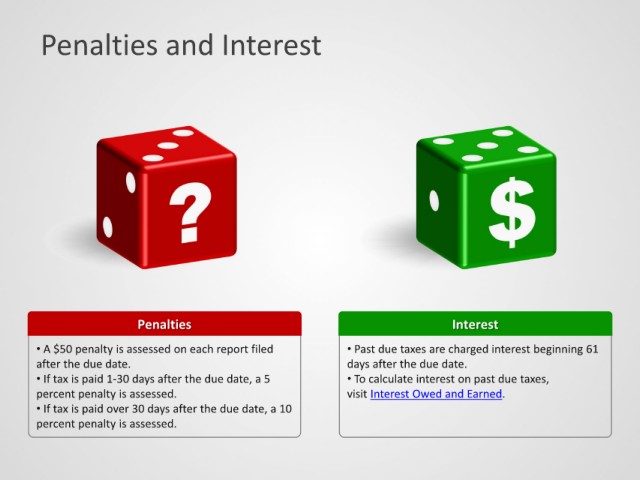

Penalties and Interest

Penalties Interest

• A $50 penalty is assessed on each report filed • Past due taxes are charged interest beginning 61

after the due date. days after the due date.

• If tax is paid 1-30 days after the due date, a 5 • To calculate interest on past due taxes,

percent penalty is assessed. visit Interest Owed and Earned.

• If tax is paid over 30 days after the due date, a 10

percent penalty is assessed.