Page 20 - Credits & Deductions in IRA_2022

P. 20

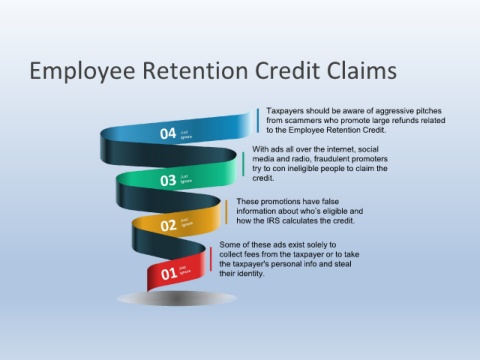

Employee Retention Credit Claims

Taxpayers should be aware of aggressive pitches

from scammers who promote large refunds related

to the Employee Retention Credit.

With ads all over the internet, social

media and radio, fraudulent promoters

try to con ineligible people to claim the

credit.

These promotions have false

information about who’s eligible and

how the IRS calculates the credit.

Some of these ads exist solely to

collect fees from the taxpayer or to take

the taxpayer's personal info and steal

their identity.