Page 11 - Tax Planning_2021

P. 11

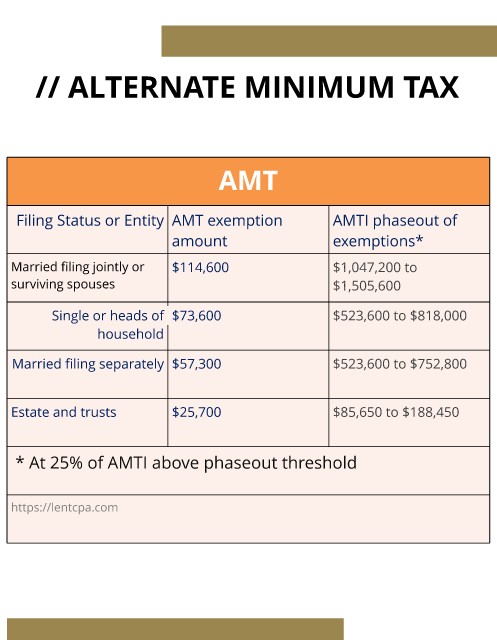

// ALTERNATE MINIMUM TAX

AMT

Filing Status or Entity AMT exemption AMTI phaseout of

amount exemptions*

Married filing jointly or $114,600 $1,047,200 to

surviving spouses $1,505,600

Single or heads of $73,600 $523,600 to $818,000

household

Married filing separately $57,300 $523,600 to $752,800

Estate and trusts $25,700 $85,650 to $188,450

* At 25% of AMTI above phaseout threshold

https://lentcpa.com