Page 43 - Calculating Lost Profits

P. 43

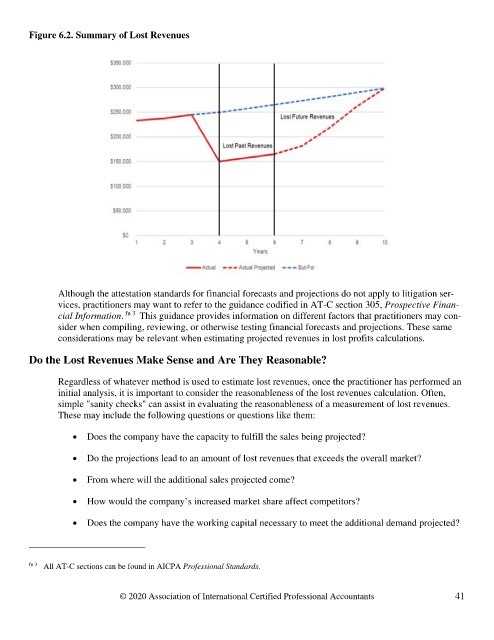

Figure 6.2. Summary of Lost Revenues

Although the attestation standards for financial forecasts and projections do not apply to litigation ser-

vices, practitioners may want to refer to the guidance codified in AT-C section 305, Prospective Finan-

cial Information. fn 3 This guidance provides information on different factors that practitioners may con-

sider when compiling, reviewing, or otherwise testing financial forecasts and projections. These same

considerations may be relevant when estimating projected revenues in lost profits calculations.

Do the Lost Revenues Make Sense and Are They Reasonable?

Regardless of whatever method is used to estimate lost revenues, once the practitioner has performed an

initial analysis, it is important to consider the reasonableness of the lost revenues calculation. Often,

simple "sanity checks" can assist in evaluating the reasonableness of a measurement of lost revenues.

These may include the following questions or questions like them:

Does the company have the capacity to fulfill the sales being projected?

Do the projections lead to an amount of lost revenues that exceeds the overall market?

From where will the additional sales projected come?

How would the company’s increased market share affect competitors?

Does the company have the working capital necessary to meet the additional demand projected?

fn 3 All AT-C sections can be found in AICPA Professional Standards.

© 2020 Association of International Certified Professional Accountants 41