Page 4 - 2020 Publication 17

P. 4

Page 2 of 138

Fileid: … ations/P17/2020/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Your Federal 14:38 - 19-Jan-2021

Income Tax

Department

of the For Individuals

Treasury

Internal

Revenue Contents

Service

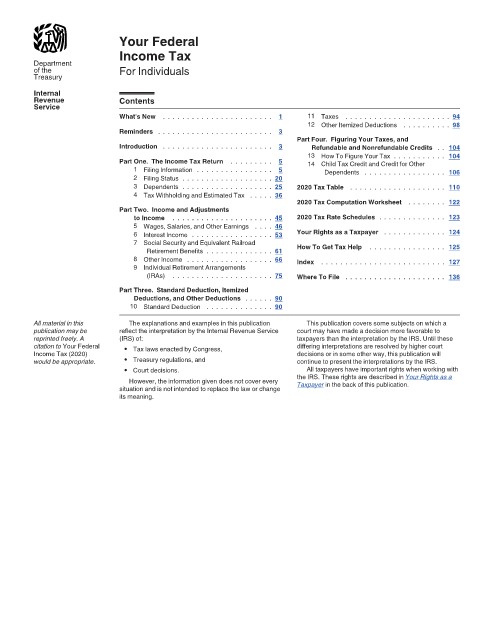

What's New . . . . . . . . . . . . . . . . . . . . . . . 1 11 Taxes . . . . . . . . . . . . . . . . . . . . . . 94

12 Other Itemized Deductions . . . . . . . . . . 98

Reminders . . . . . . . . . . . . . . . . . . . . . . . . 3

Part Four. Figuring Your Taxes, and

Introduction . . . . . . . . . . . . . . . . . . . . . . . 3 Refundable and Nonrefundable Credits . . 104

13 How To Figure Your Tax . . . . . . . . . . . 104

Part One. The Income Tax Return . . . . . . . . . 5 14 Child Tax Credit and Credit for Other

1 Filing Information . . . . . . . . . . . . . . . . 5 Dependents . . . . . . . . . . . . . . . . . 106

2 Filing Status . . . . . . . . . . . . . . . . . . . 20

3 Dependents . . . . . . . . . . . . . . . . . . . 25 2020 Tax Table . . . . . . . . . . . . . . . . . . . . 110

4 Tax Withholding and Estimated Tax . . . . . 36

2020 Tax Computation Worksheet . . . . . . . . 122

Part Two. Income and Adjustments

to Income . . . . . . . . . . . . . . . . . . . . . 45 2020 Tax Rate Schedules . . . . . . . . . . . . . . 123

5 Wages, Salaries, and Other Earnings . . . . 46

6 Interest Income . . . . . . . . . . . . . . . . . 53 Your Rights as a Taxpayer . . . . . . . . . . . . . 124

7 Social Security and Equivalent Railroad How To Get Tax Help . . . . . . . . . . . . . . . . 125

Retirement Benefits . . . . . . . . . . . . . . 61

8 Other Income . . . . . . . . . . . . . . . . . . 66 Index . . . . . . . . . . . . . . . . . . . . . . . . . . 127

9 Individual Retirement Arrangements

(IRAs) . . . . . . . . . . . . . . . . . . . . . 75 Where To File . . . . . . . . . . . . . . . . . . . . . 136

Part Three. Standard Deduction, Itemized

Deductions, and Other Deductions . . . . . . 90

10 Standard Deduction . . . . . . . . . . . . . . 90

All material in this The explanations and examples in this publication This publication covers some subjects on which a

publication may be reflect the interpretation by the Internal Revenue Service court may have made a decision more favorable to

reprinted freely. A (IRS) of: taxpayers than the interpretation by the IRS. Until these

citation to Your Federal • Tax laws enacted by Congress, differing interpretations are resolved by higher court

Income Tax (2020) decisions or in some other way, this publication will

would be appropriate. • Treasury regulations, and continue to present the interpretations by the IRS.

• Court decisions. All taxpayers have important rights when working with

However, the information given does not cover every the IRS. These rights are described in Your Rights as a

situation and is not intended to replace the law or change Taxpayer in the back of this publication.

its meaning.