Page 52 - Dependents for Individuals

P. 52

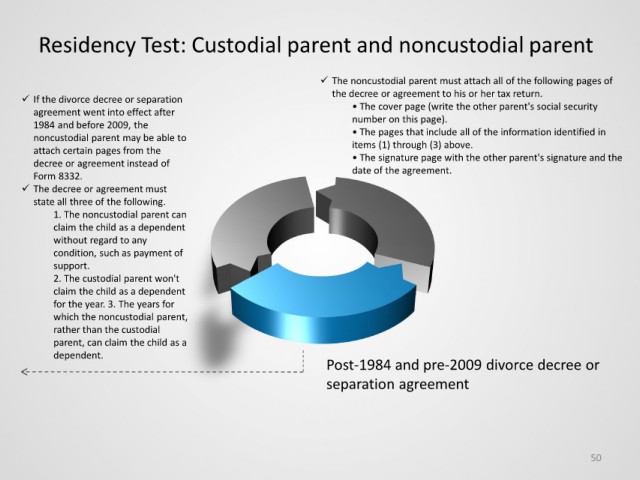

Residency Test: Custodial parent and noncustodial parent

The noncustodial parent must attach all of the following pages of

If the divorce decree or separation the decree or agreement to his or her tax return.

agreement went into effect after • The cover page (write the other parent's social security

number on this page).

1984 and before 2009, the

noncustodial parent may be able to • The pages that include all of the information identified in

attach certain pages from the items (1) through (3) above.

decree or agreement instead of • The signature page with the other parent's signature and the

Form 8332. date of the agreement.

The decree or agreement must

state all three of the following.

1. The noncustodial parent can

claim the child as a dependent

without regard to any

condition, such as payment of

support.

2. The custodial parent won't

claim the child as a dependent

for the year. 3. The years for

which the noncustodial parent,

rather than the custodial

parent, can claim the child as a

dependent.

Post-1984 and pre-2009 divorce decree or

separation agreement

50