Page 68 - Dependents for Individuals

P. 68

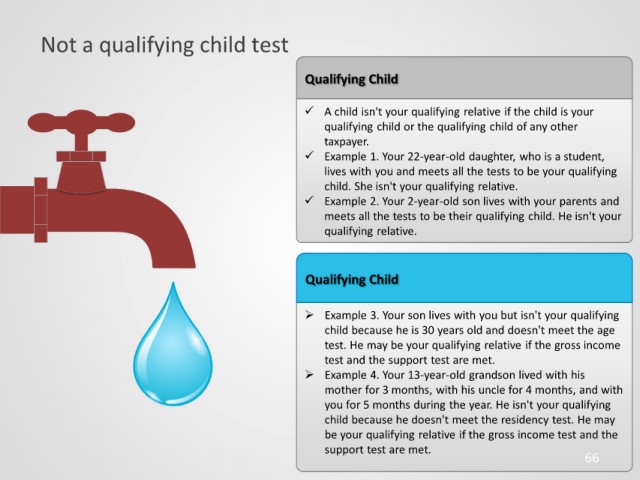

Not a qualifying child test

Qualifying Child

A child isn't your qualifying relative if the child is your

qualifying child or the qualifying child of any other

taxpayer.

Example 1. Your 22-year-old daughter, who is a student,

lives with you and meets all the tests to be your qualifying

child. She isn't your qualifying relative.

Example 2. Your 2-year-old son lives with your parents and

meets all the tests to be their qualifying child. He isn't your

qualifying relative.

Qualifying Child

Example 3. Your son lives with you but isn't your qualifying

child because he is 30 years old and doesn't meet the age

test. He may be your qualifying relative if the gross income

test and the support test are met.

Example 4. Your 13-year-old grandson lived with his

mother for 3 months, with his uncle for 4 months, and with

you for 5 months during the year. He isn't your qualifying

child because he doesn't meet the residency test. He may

be your qualifying relative if the gross income test and the

support test are met.

66