Page 7 - Dependents for Individuals

P. 7

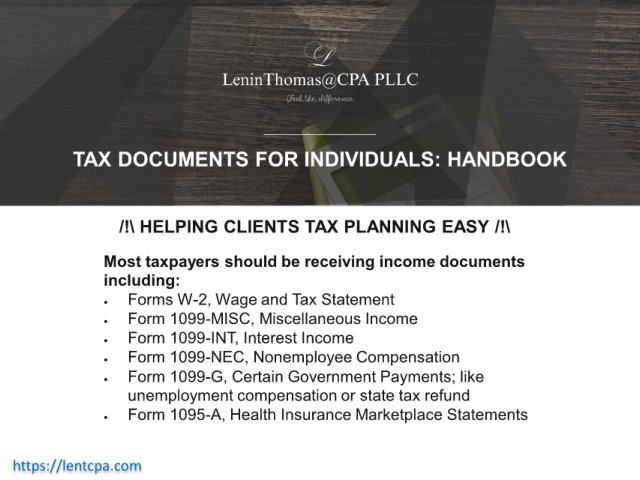

TAX DOCUMENTS FOR INDIVIDUALS: HANDBOOK

/!\ HELPING CLIENTS TAX PLANNING EASY /!\

Most taxpayers should be receiving income documents

including:

• Forms W-2, Wage and Tax Statement

• Form 1099-MISC, Miscellaneous Income

• Form 1099-INT, Interest Income

• Form 1099-NEC, Nonemployee Compensation

• Form 1099-G, Certain Government Payments; like

unemployment compensation or state tax refund

• Form 1095-A, Health Insurance Marketplace Statements

https://lentcpa.com