Page 13 - Tax reforms - Individuals

P. 13

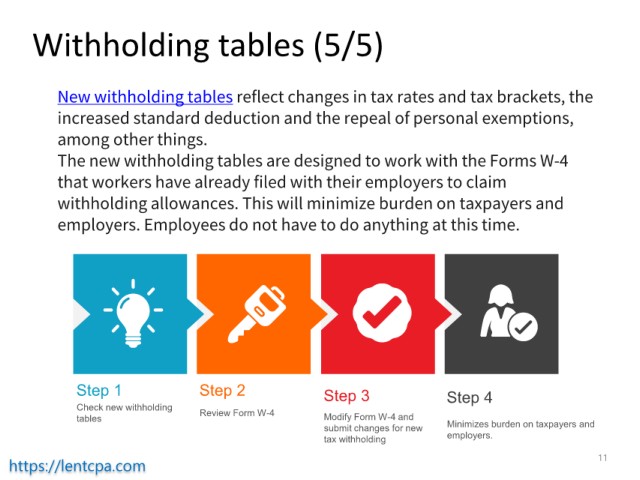

Withholding tables (5/5)

New withholding tables reflect changes in tax rates and tax brackets, the

increased standard deduction and the repeal of personal exemptions,

among other things.

The new withholding tables are designed to work with the Forms W-4

that workers have already filed with their employers to claim

withholding allowances. This will minimize burden on taxpayers and

employers. Employees do not have to do anything at this time.

Step 1 Step 2 Step 3 Step 4

Check new withholding Review Form W-4

tables Modify Form W-4 and

submit changes for new Minimizes burden on taxpayers and

tax withholding employers.

11

https://lentcpa.com