Page 19 - Tax Reforms - Businesses

P. 19

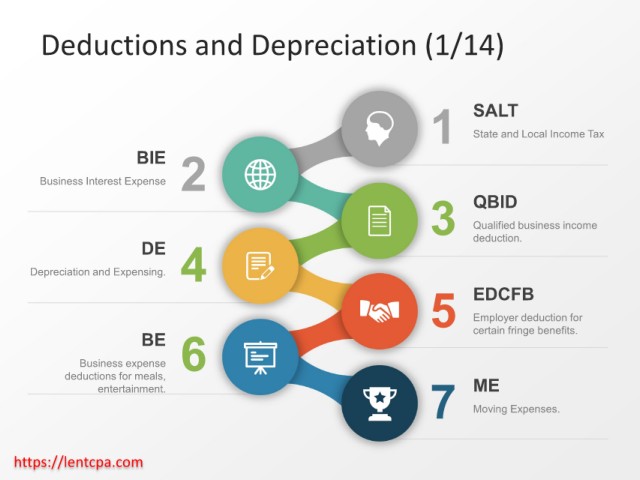

Deductions and Depreciation (1/14)

1 SALT

State and Local Income Tax

BIE 2

Business Interest Expense

3 QBID

Qualified business income

DE 4 deduction.

Depreciation and Expensing.

5 EDCFB

Employer deduction for

BE 6 certain fringe benefits.

Business expense

7 Moving Expenses.

deductions for meals,

entertainment. ME

https://lentcpa.com