Page 50 - Tax Reforms - Businesses

P. 50

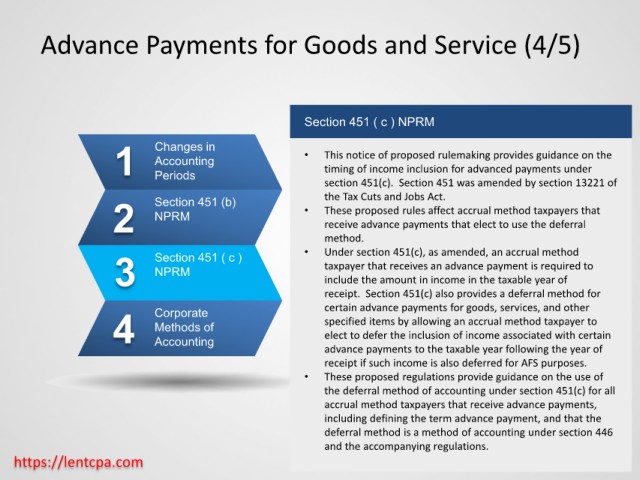

Advance Payments for Goods and Service (4/5)

Section 451 ( c ) NPRM

1 Changes in • This notice of proposed rulemaking provides guidance on the

Accounting

timing of income inclusion for advanced payments under

Periods

section 451(c). Section 451 was amended by section 13221 of

the Tax Cuts and Jobs Act.

2 Section 451 (b) • These proposed rules affect accrual method taxpayers that

NPRM

receive advance payments that elect to use the deferral

method.

3 Section 451 ( c ) taxpayer that receives an advance payment is required to

•

Under section 451(c), as amended, an accrual method

NPRM

include the amount in income in the taxable year of

receipt. Section 451(c) also provides a deferral method for

certain advance payments for goods, services, and other

4 Corporate specified items by allowing an accrual method taxpayer to

Methods of

elect to defer the inclusion of income associated with certain

Accounting

advance payments to the taxable year following the year of

receipt if such income is also deferred for AFS purposes.

• These proposed regulations provide guidance on the use of

the deferral method of accounting under section 451(c) for all

accrual method taxpayers that receive advance payments,

including defining the term advance payment, and that the

deferral method is a method of accounting under section 446

and the accompanying regulations.

https://lentcpa.com