Page 694 - COSO Guidance Book

P. 694

Thought Leadership in ERM | Enterprise Risk Management — Understanding and Communicating Risk Appetite | 5

An organization has a number of goals and objectives it

can pursue. Ultimately, it will decide on those that best One major problem that led to the current financial crisis was

meet stakeholder preferences for growth, return, safety, that although objectives had been created, there was no

sustainability and its willingness to accept risk. The articulation of risk appetite or identification of those

objectives, in turn, may be pursued using a number of responsible when risks were incurred.

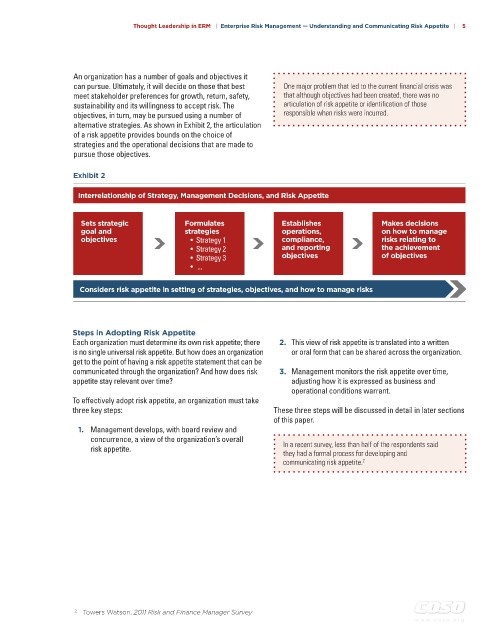

alternative strategies. As shown in Exhibit 2, the articulation

of a risk appetite provides bounds on the choice of

strategies and the operational decisions that are made to

pursue those objectives.

Exhibit 2

interrelationship of Strategy, Management Decisions, and Risk Appetite

Sets strategic Formulates Establishes Makes decisions

goal and strategies operations, on how to manage

objectives • Strategy 1 compliance, risks relating to

• Strategy 2 and reporting the achievement

• Strategy 3 objectives of objectives

• ...

Considers risk appetite in setting of strategies, objectives, and how to manage risks

Steps in Adopting Risk Appetite

Each organization must determine its own risk appetite; there 2. This view of risk appetite is translated into a written

is no single universal risk appetite. But how does an organization or oral form that can be shared across the organization.

get to the point of having a risk appetite statement that can be

communicated through the organization? And how does risk 3. Management monitors the risk appetite over time,

appetite stay relevant over time? adjusting how it is expressed as business and

operational conditions warrant.

To effectively adopt risk appetite, an organization must take

three key steps: These three steps will be discussed in detail in later sections

of this paper.

1. Management develops, with board review and

concurrence, a view of the organization’s overall In a recent survey, less than half of the respondents said

risk appetite.

they had a formal process for developing and

communicating risk appetite. 2

2 Towers Watson, 2011 Risk and Finance Manager Survey

w w w . c o s o . o r g