Page 2 - Tax Planning

P. 2

OBJECTIVE

Taking simple steps will ease your stress and give an head-start

for tax planning each year. Our tax planning steps give clear

instructions for what needs to be done & when, so that your

year-end tax filing becomes easier.

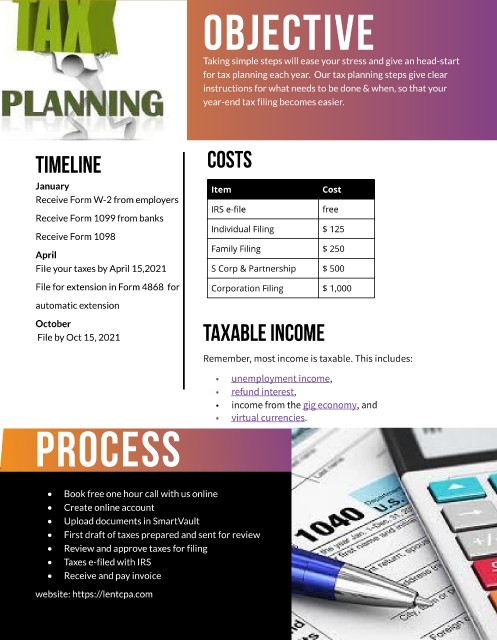

TIMELINE COSTS

January It em Cost

Receive Form W-2 from employers

IRS e-file free

Receive Form 1099 from banks

Individual Filing $ 125

Receive Form 1098

Family Filing $ 250

April

FiIe your taxes by April 15,2021 S Corp & Partnership $ 500

File for extension in Form 4868 for Corporation Filing $ 1,000

automatic extension

October

File by Oct 15, 2021 taxable income

Remember, most income is taxable. This includes:

- unemployment income,

- refund interest,

- income from the gig economy, and

- virtual currencies.

Process

- Book free one hour call with us online

- Create online account

- Upload documents in SmartVault

- First draft of taxes prepared and sent for review

- Review and approve taxes for filing

- Taxes e-filed with IRS

- Receive and pay invoice

website: https://lentcpa.com