Page 9 - Tax Planning

P. 9

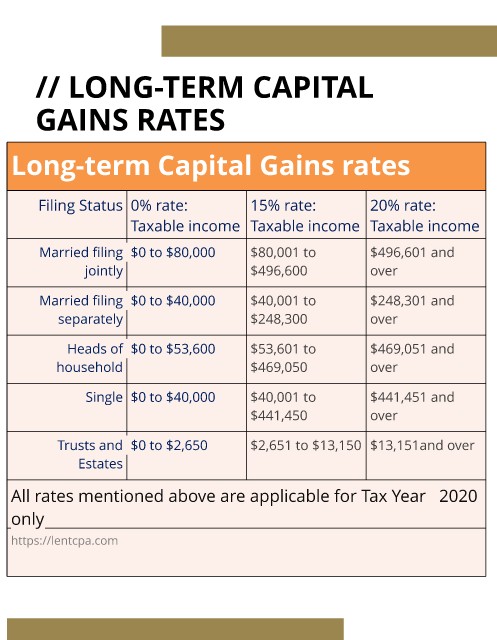

// LONG-TERM CAPITAL

GAINS RATES

Long-t erm Capit al Gains rat es

Filing Status 0% rate: 15% rate: 20% rate:

Taxable income Taxable income Taxable income

Married filing $0 to $80,000 $80,001 to $496,601 and

jointly $496,600 over

Married filing $0 to $40,000 $40,001 to $248,301 and

separately $248,300 over

Heads of $0 to $53,600 $53,601 to $469,051 and

household $469,050 over

Single $0 to $40,000 $40,001 to $441,451 and

$441,450 over

Trusts and $0 to $2,650 $2,651 to $13,150 $13,151and over

Estates

All rates mentioned above are applicable for Tax Year 2020

only

https://lentcpa.com