Page 17 - Interest Income - Individuals Handbook

P. 17

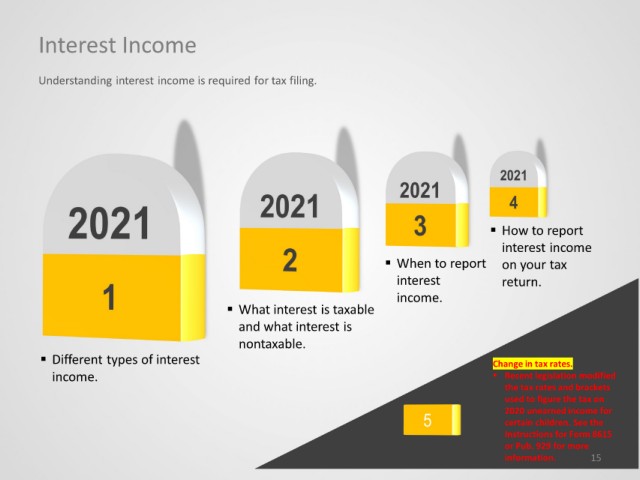

Interest Income

Understanding interest income is required for tax filing.

How to report

interest income

When to report on your tax

interest return.

income.

What interest is taxable

and what interest is

nontaxable.

Different types of interest Change in tax rates.

income. Recent legislation modified

the tax rates and brackets

used to figure the tax on

2020 unearned income for

certain children. See the

Instructions for Form 8615

or Pub. 929 for more

information. 15