Page 24 - Interest Income - Individuals Handbook

P. 24

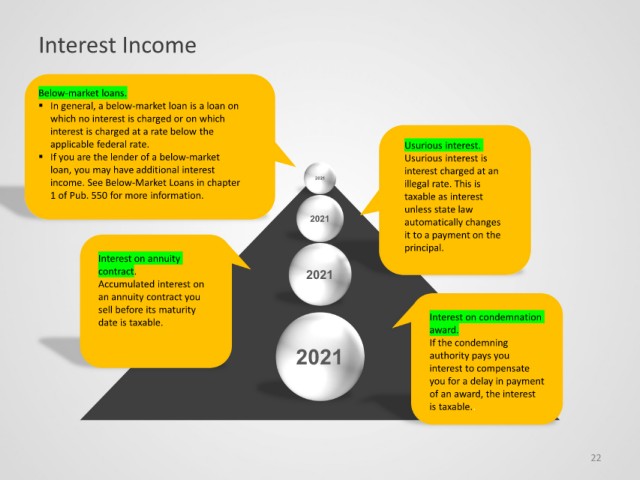

Interest Income

Below-market loans.

In general, a below-market loan is a loan on

which no interest is charged or on which

interest is charged at a rate below the

applicable federal rate. Usurious interest.

If you are the lender of a below-market Usurious interest is

loan, you may have additional interest interest charged at an

income. See Below-Market Loans in chapter 2021 illegal rate. This is

1 of Pub. 550 for more information. taxable as interest

unless state law

2021 automatically changes

it to a payment on the

principal.

Interest on annuity

contract. 2021

Accumulated interest on

an annuity contract you

sell before its maturity

date is taxable. Interest on condemnation

award.

If the condemning

2021 authority pays you

interest to compensate

you for a delay in payment

of an award, the interest

is taxable..

22