Page 42 - Interest Income - Individuals Handbook

P. 42

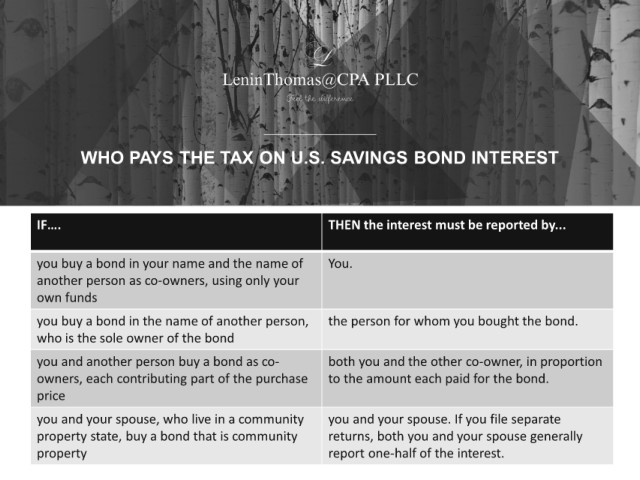

WHO PAYS THE TAX ON U.S. SAVINGS BOND INTEREST

IF…. THEN the interest must be reported by...

you buy a bond in your name and the name of You.

another person as co-owners, using only your

own funds

you buy a bond in the name of another person, the person for whom you bought the bond.

who is the sole owner of the bond

you and another person buy a bond as co- both you and the other co-owner, in proportion

owners, each contributing part of the purchase to the amount each paid for the bond.

price

you and your spouse, who live in a community you and your spouse. If you file separate

property state, buy a bond that is community returns, both you and your spouse generally

property report one-half of the interest.