Page 87 - Interest Income - Individuals Handbook

P. 87

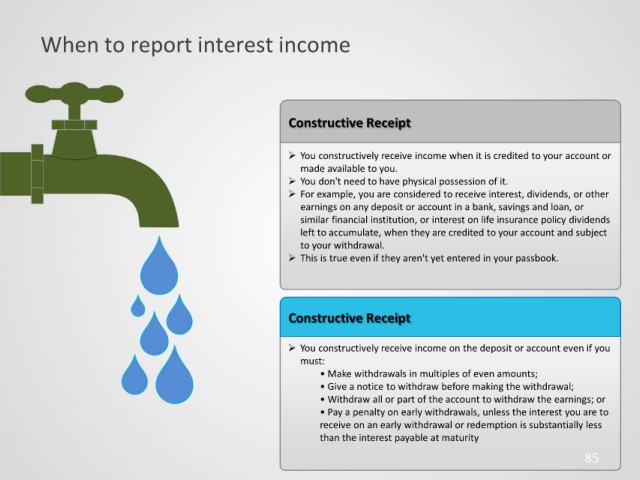

When to report interest income

Constructive Receipt

You constructively receive income when it is credited to your account or

made available to you.

You don't need to have physical possession of it.

For example, you are considered to receive interest, dividends, or other

earnings on any deposit or account in a bank, savings and loan, or

similar financial institution, or interest on life insurance policy dividends

left to accumulate, when they are credited to your account and subject

to your withdrawal.

This is true even if they aren't yet entered in your passbook.

Constructive Receipt

You constructively receive income on the deposit or account even if you

must:

• Make withdrawals in multiples of even amounts;

• Give a notice to withdraw before making the withdrawal;

• Withdraw all or part of the account to withdraw the earnings; or

• Pay a penalty on early withdrawals, unless the interest you are to

receive on an early withdrawal or redemption is substantially less

than the interest payable at maturity

85