Page 31 - IRS - Owning a Business

P. 31

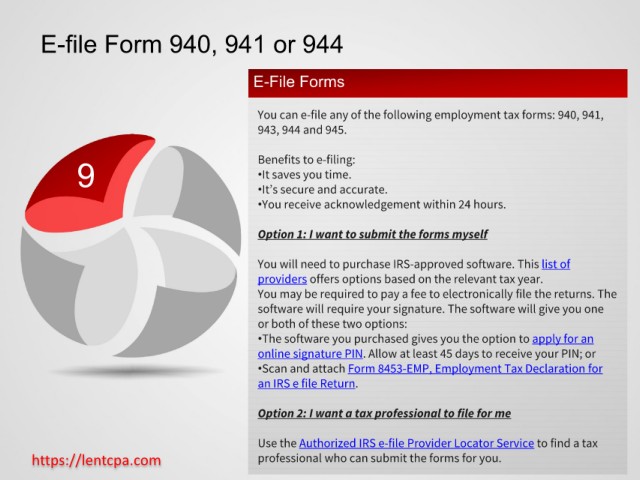

E-file Form 940, 941 or 944

E-File Forms

You can e-file any of the following employment tax forms: 940, 941,

943, 944 and 945.

9 Benefits to e-filing:

•It saves you time.

•It’s secure and accurate.

•You receive acknowledgement within 24 hours.

Option 1: I want to submit the forms myself

You will need to purchase IRS-approved software. This list of

providers offers options based on the relevant tax year.

You may be required to pay a fee to electronically file the returns. The

software will require your signature. The software will give you one

or both of these two options:

•The software you purchased gives you the option to apply for an

online signature PIN. Allow at least 45 days to receive your PIN; or

•Scan and attach Form 8453-EMP, Employment Tax Declaration for

an IRS e file Return.

Option 2: I want a tax professional to file for me

Use the Authorized IRS e-file Provider Locator Service to find a tax

https://lentcpa.com professional who can submit the forms for you.