Page 8 - Payroll Year-End Planning & Checklist

P. 8

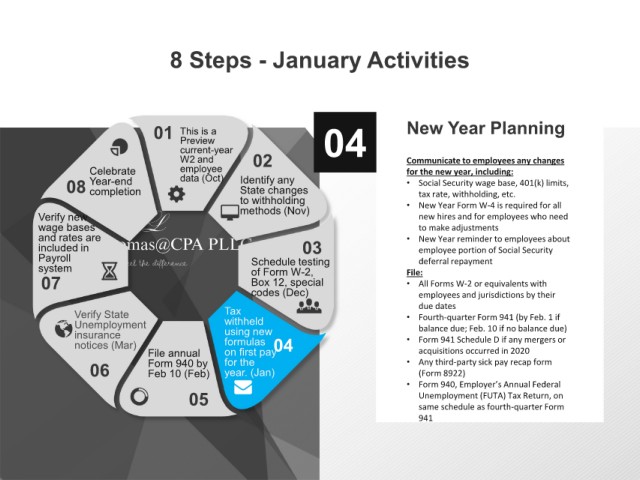

8 Steps - January Activities

01 This is a 04 New Year Planning

Preview

current-year

W2 and 02 Communicate to employees any changes

Celebrate employee for the new year, including:

08 Year-end data (Oct) Identify any • Social Security wage base, 401(k) limits,

State changes

completion

tax rate, withholding, etc.

to withholding • New Year Form W-4 is required for all

Verify new methods (Nov) new hires and for employees who need

wage bases to make adjustments

and rates are • New Year reminder to employees about

included in 03 employee portion of Social Security

Payroll Schedule testing deferral repayment

system of Form W-2, File:

07 Box 12, special • All Forms W-2 or equivalents with

codes (Dec) employees and jurisdictions by their

due dates

Verify State Tax • Fourth-quarter Form 941 (by Feb. 1 if

Unemployment withheld balance due; Feb. 10 if no balance due)

insurance using new • Form 941 Schedule D if any mergers or

notices (Mar) formulas 04

File annual on first pay acquisitions occurred in 2020

06 Form 940 by for the • Any third-party sick pay recap form

year. (Jan)

(Form 8922)

Feb 10 (Feb)

• Form 940, Employer’s Annual Federal

05 Unemployment (FUTA) Tax Return, on

same schedule as fourth-quarter Form

941