Page 103 - Wages, Salaries and Other Earnings

P. 103

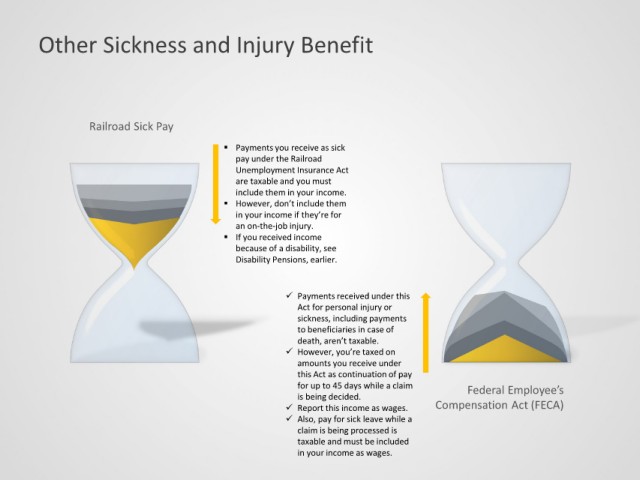

Other Sickness and Injury Benefit

Railroad Sick Pay

Payments you receive as sick

pay under the Railroad

Unemployment Insurance Act

are taxable and you must

include them in your income.

However, don’t include them

in your income if they’re for

an on-the-job injury.

If you received income

because of a disability, see

Disability Pensions, earlier.

Payments received under this

Act for personal injury or

sickness, including payments

to beneficiaries in case of

death, aren’t taxable.

However, you’re taxed on

amounts you receive under

this Act as continuation of pay

for up to 45 days while a claim Federal Employee’s

is being decided.

Report this income as wages. Compensation Act (FECA)

Also, pay for sick leave while a

claim is being processed is

taxable and must be included

in your income as wages.