Page 464 - MANUAL OF SOP

P. 464

General Issues

internal rate of return of 12 per cent based on long term marginal costing

depending upon the option for any of the specified rates of return that may

be exercised by the manufacturer of a bulk drug:

Provided that the option with regard to the rate of return once exercised by

a manufacturer shall be final and for any change in the said rate of return

prior approval of the government shall be necessary.

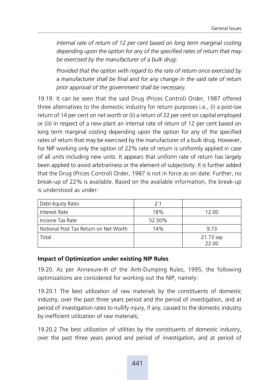

19.19. It can be seen that the said Drug (Prices Control) Order, 1987 offered

three alternatives to the domestic industry for return purposes i.e., (i) a post-tax

return of 14 per cent on net worth or (ii) a return of 22 per cent on capital employed

or (iii) in respect of a new plant an internal rate of return of 12 per cent based on

long term marginal costing depending upon the option for any of the specified

rates of return that may be exercised by the manufacturer of a bulk drug. However,

for NIP working only the option of 22% rate of return is uniformly applied in case

of all units including new units. It appears that uniform rate of return has largely

been applied to avoid arbitrariness or the element of subjectivity. It is further added

that the Drug (Prices Control) Order, 1987 is not in force as on date. Further, no

break-up of 22% is available. Based on the available information, the break-up

is understood as under:

Debt-Equity Ratio 2:1

Interest Rate 18% 12.00

Income Tax Rate 52.50%

Notional Post Tax Return on Net Worth 14% 9.73

Total 21.73 say

22.00

Impact of Optimization under existing NIP Rules

19.20. As per Annexure-III of the Anti-Dumping Rules, 1995, the following

optimizations are considered for working out the NIP, namely:

19.20.1 The best utilization of raw materials by the constituents of domestic

industry, over the past three years period and the period of investigation, and at

period of investigation rates to nullify injury, if any, caused to the domestic industry

by inefficient utilization of raw materials;

19.20.2 The best utilization of utilities by the constituents of domestic industry,

over the past three years period and period of investigation, and at period of

441