Page 486 - MANUAL OF SOP

P. 486

Countervailing Duty Investigations

(vi) the address to which representatives by interested countries and interested

parties should be directed;

(vii) the time-limits allowed to interested countries and interested parties for

making their views known.

20.39 Upon initiation of an investigation, the non-confidential version of the

application is shared with all the interested parties and also kept in the inspection

folder to be made available to all the registered interested parties.

POST-INITIATION: SUBMISSION OF DOCUMENTS

20.40 The embassy of exporting country, exporters/producers of the exporting

country and importers and the user industry in India are issued a questionnaire giving

40 days’ time, from the date of letter/issuance of questionnaires, for submitting

the response/reply/submissions by the respondents. It may be noted that this time

period is only for the initial comprehensive questionnaire and does not apply to the

subsequent or supplementary questionnaires, if any issued .

21

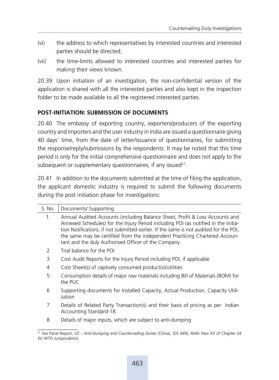

20.41 In addition to the documents submitted at the time of filing the application,

the applicant domestic industry is required to submit the following documents

during the post initiation phase for investigations:

S. No. Documents/ Supporting

1. Annual Audited Accounts (including Balance Sheet, Profit & Loss Accounts and

Annexed Schedules) for the Injury Period including POI (as notified in the Initia-

tion Notification), if not submitted earlier. If the same is not audited for the POI,

the same may be certified from the independent Practicing Chartered Accoun-

tant and the duly Authorised Officer of the Company.

2 Trial balance for the POI

3 Cost Audit Reports for the Injury Period including POI, if applicable

4 Cost Sheet(s) of captively consumed product(s)/utilities

5 Consumption details of major raw materials including Bill of Materials (BOM) for

the PUC

6 Supporting documents for Installed Capacity, Actual Production, Capacity Utili-

zation

7 Details of Related Party Transaction(s) and their basis of pricing as per Indian

Accounting Standard-18

8 Details of major inputs, which are subject to anti-dumping

21 See Panel Report, US – Anti-Dumping and Countervailing Duties (China), (DS 449), Refer Para XX of Chapter 24

for WTO Jurisprudence.

463