Page 2 - Test

P. 2

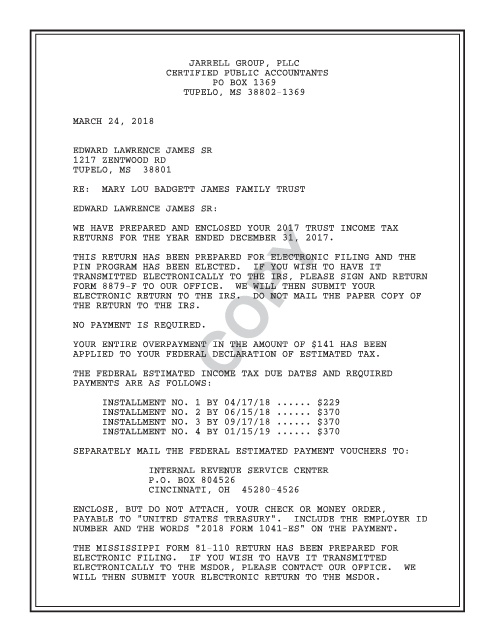

JARRELL GROUP, PLLC

CERTIFIED PUBLIC ACCOUNTANTS

PO BOX 1369

TUPELO, MS 38802-1369

MARCH 24, 2018

EDWARD LAWRENCE JAMES SR

1217 ZENTWOOD RD

TUPELO, MS 38801

RE: MARY LOU BADGETT JAMES FAMILY TRUST

EDWARD LAWRENCE JAMES SR:

WE HAVE PREPARED AND ENCLOSED YOUR 2017 TRUST INCOME TAX

RETURNS FOR THE YEAR ENDED DECEMBER 31, 2017.

THIS RETURN HAS BEEN PREPARED FOR ELECTRONIC FILING AND THE

PIN PROGRAM HAS BEEN ELECTED. IF YOU WISH TO HAVE IT

TRANSMITTED ELECTRONICALLY TO THE IRS, PLEASE SIGN AND RETURN

FORM 8879-F TO OUR OFFICE. WE WILL THEN SUBMIT YOUR

ELECTRONIC RETURN TO THE IRS. DO NOT MAIL THE PAPER COPY OF

THE RETURN TO THE IRS. COPY

NO PAYMENT IS REQUIRED.

YOUR ENTIRE OVERPAYMENT IN THE AMOUNT OF $141 HAS BEEN

APPLIED TO YOUR FEDERAL DECLARATION OF ESTIMATED TAX.

THE FEDERAL ESTIMATED INCOME TAX DUE DATES AND REQUIRED

PAYMENTS ARE AS FOLLOWS:

INSTALLMENT NO. 1 BY 04/17/18 ...... $229

INSTALLMENT NO. 2 BY 06/15/18 ...... $370

INSTALLMENT NO. 3 BY 09/17/18 ...... $370

INSTALLMENT NO. 4 BY 01/15/19 ...... $370

SEPARATELY MAIL THE FEDERAL ESTIMATED PAYMENT VOUCHERS TO:

INTERNAL REVENUE SERVICE CENTER

P.O. BOX 804526

CINCINNATI, OH 45280-4526

ENCLOSE, BUT DO NOT ATTACH, YOUR CHECK OR MONEY ORDER,

PAYABLE TO "UNITED STATES TREASURY". INCLUDE THE EMPLOYER ID

NUMBER AND THE WORDS "2018 FORM 1041-ES" ON THE PAYMENT.

THE MISSISSIPPI FORM 81-110 RETURN HAS BEEN PREPARED FOR

ELECTRONIC FILING. IF YOU WISH TO HAVE IT TRANSMITTED

ELECTRONICALLY TO THE MSDOR, PLEASE CONTACT OUR OFFICE. WE

WILL THEN SUBMIT YOUR ELECTRONIC RETURN TO THE MSDOR.