Page 31 - January 2023 Report

P. 31

Resilience

Investment Committee meeting minutes (draft) (3)

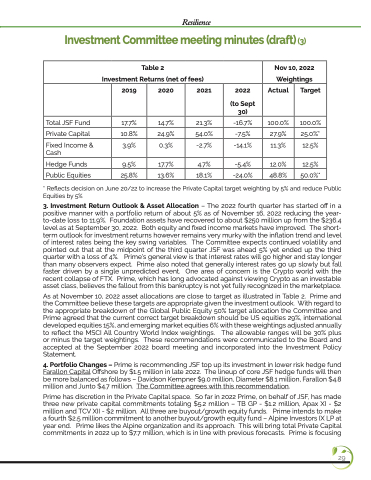

Table 2

Investment Returns (net of fees)

Nov 10, 2022 Weightings

2019

2020

2021

2022

(to Sept 30)

Actual

Target

Total JSF Fund

Private Capital

Hedge Funds

Public Equities

17.7% 14.7%

10.8% 24.9%

9.5% 17.7%

25.8% 13.6%

21.3%

54.0% 4.7%

18.1%

-16.7%

-7.5% -5.4%

-24.0%

100.0%

27.9%

12.0%

48.8%

100.0%

25.0%* 12.5%

50.0%*

Fixed Income & Cash

3.9%

0.3%

-2.7%

-14.1%

11.3%

12.5%

* Reflects decision on June 20/22 to increase the Private Capital target weighting by 5% and reduce Public Equities by 5%

3. Investment Return Outlook & Asset Allocation – The 2022 fourth quarter has started off in a positive manner with a portfolio return of about 5% as of November 16, 2022 reducing the year- to-date loss to 11.9%. Foundation assets have recovered to about $250 million up from the $236.4 level as at September 30, 2022. Both equity and fixed income markets have improved. The short- term outlook for investment returns however remains very murky with the inflation trend and level of interest rates being the key swing variables. The Committee expects continued volatility and pointed out that at the midpoint of the third quarter JSF was ahead 5% yet ended up the third quarter with a loss of 4%. Prime’s general view is that interest rates will go higher and stay longer than many observers expect. Prime also noted that generally interest rates go up slowly but fall faster driven by a single unpredicted event. One area of concern is the Crypto world with the recent collapse of FTX. Prime, which has long advocated against viewing Crypto as an investable asset class, believes the fallout from this bankruptcy is not yet fully recognized in the marketplace.

As at November 10, 2022 asset allocations are close to target as illustrated in Table 2. Prime and the Committee believe these targets are appropriate given the investment outlook. With regard to the appropriate breakdown of the Global Public Equity 50% target allocation the Committee and Prime agreed that the current correct target breakdown should be US equities 29%, international developed equities 15%, and emerging market equities 6% with these weightings adjusted annually to reflect the MSCI All Country World Index weightings. The allowable ranges will be 30% plus or minus the target weightings. These recommendations were communicated to the Board and accepted at the September 2022 board meeting and incorporated into the Investment Policy Statement.

4. Portfolio Changes – Prime is recommending JSF top up its investment in lower risk hedge fund Farallon Capital Offshore by $1.5 million in late 2022. The lineup of core JSF hedge funds will then be more balanced as follows – Davidson Kempner $9.0 million, Diameter $8.1 million, Farallon $4.8 million and Junto $4.7 million. The Committee agrees with this recommendation.

Prime has discretion in the Private Capital space. So far in 2022 Prime, on behalf of JSF, has made three new private capital commitments totaling $5.2 million – TB GP - $1.2 million, Apax XI - $2 million and TCV XII - $2 million. All three are buyout/growth equity funds. Prime intends to make a fourth $2.5 million commitment to another buyout/growth equity fund – Alpine Investors IX LP at year end. Prime likes the Alpine organization and its approach. This will bring total Private Capital commitments in 2022 up to $7.7 million, which is in line with previous forecasts. Prime is focusing

29