Page 30 - January 2023 Report

P. 30

January Report 2023

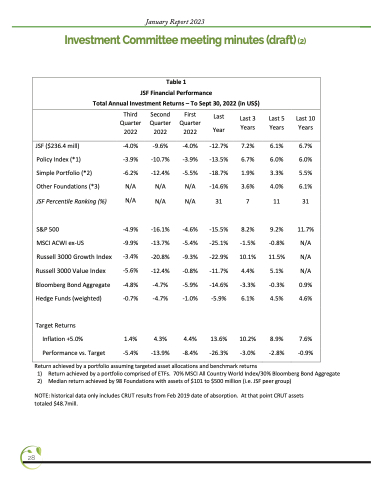

Investment Committee meeting minutes (draft) (2)

Table 1

JSF Financial Performance

Total Annual Investment Returns – To Sept 30, 2022 (in US$)

Third Quarter 2022

Second Quarter 2022

First Quarter 2022

Last Year

Last 3 Years

Last 5 Years

Last 10 Years

JSF ($236.4 mill)

Policy Index (*1)

Simple Portfolio (*2) Other Foundations (*3) JSF Percentile Ranking (%)

S&P 500

MSCI ACWI ex-US

Russell 3000 Growth Index

Russell 3000 Value Index Bloomberg Bond Aggregate Hedge Funds (weighted)

Target Returns

Inflation +5.0% Performance vs. Target

-4.0% -9.6% -4.0% -3.9% -10.7% -3.9% -6.2% -12.4% -5.5% N/A N/A N/A N/A N/A N/A

-4.9% -16.1% -4.6% -9.9% -13.7% -5.4% -3.4% -20.8% -9.3% -5.6% -12.4% -0.8% -4.8% -4.7% -5.9% -0.7% -4.7% -1.0%

1.4% 4.3% 4.4% -5.4% -13.9% -8.4%

-12.7% 7.2% -13.5% 6.7% -18.7% 1.9% -14.6% 3.6% 31 7

-15.5% 8.2% -25.1% -1.5% -22.9% 10.1% -11.7% 4.4% -14.6% -3.3% -5.9% 6.1%

13.6% 10.2% -26.3% -3.0%

6.1% 6.7% 6.0% 6.0% 3.3% 5.5% 4.0% 6.1% 11 31

9.2% 11.7% -0.8% N/A 11.5% N/A 5.1% N/A

-0.3% 0.9% 4.5% 4.6%

8.9% 7.6% -2.8% -0.9%

Return achieved by a portfolio assuming targeted asset allocations and benchmark returns

1) Return achieved by a portfolio comprised of ETFs. 70% MSCI All Country World Index/30% Bloomberg Bond Aggregate 2) Median return achieved by 98 Foundations with assets of $101 to $500 million (i.e. JSF peer group)

NOTE: historical data only includes CRUT results from Feb 2019 date of absorption. At that point CRUT assets totaled $48.7mill.

28