Page 42 - 2024 July report

P. 42

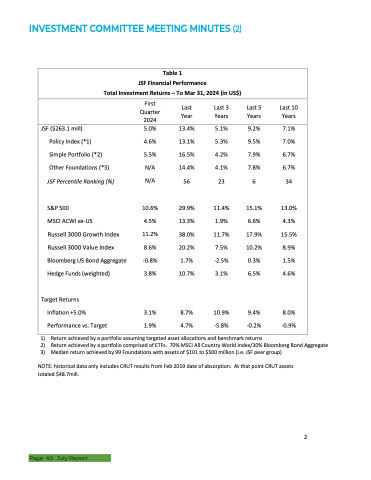

INVESTMENT COMMITTEE MEETING MINUTES (2)

Table 1

JSF Financial Performance

Total Investment Returns – To Mar 31, 2024 (in US$)

First Quarter 2024

Last Last 3 Last 5 Last 10 Year Years Years Years

JSF ($263.1 mill)

Policy Index (*1) Simple Portfolio (*2) Other Foundations (*3)

JSF Percentile Ranking (%)

S&P 500

MSCI ACWI ex-US

Russell 3000 Growth Index Russell 3000 Value Index Bloomberg US Bond Aggregate Hedge Funds (weighted)

Target Returns

Inflation +5.0% Performance vs. Target

5.0% 13.4% 4.6% 13.1% 5.5% 16.5% N/A 14.4%

N/A 56

10.6% 29.9% 4.5% 13.3% 11.2% 38.0% 8.6% 20.2%

-0.8% 1.7% 3.8% 10.7%

3.1% 8.7%

1.9% 4.7%

5.1% 9.2% 7.1% 5.3% 9.5% 7.0% 4.2% 7.9% 6.7% 4.1% 7.8% 6.7% 23 6 34

11.4% 15.1% 13.0% 1.9% 6.6% 4.3% 11.7% 17.9% 15.5% 7.5% 10.2% 8.9% -2.5% 0.3% 1.5% 3.1% 6.5% 4.6%

10.9% 9.4% 8.0% -5.8% -0.2% -0.9%

1) 2) 3)

Return achieved by a portfolio assuming targeted asset allocations and benchmark returns

Return achieved by a portfolio comprised of ETFs. 70% MSCI All Country World Index/30% Bloomberg Bond Aggregate Median return achieved by 99 Foundations with assets of $101 to $500 million (i.e. JSF peer group)

NOTE: historical data only includes CRUT results from Feb 2019 date of absorption. At that point CRUT assets totaled $48.7mill.

2

Page 40 July Report