Page 11 - CA Final GST

P. 11

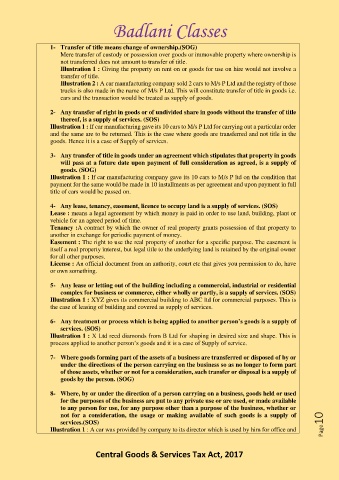

Badlani Classes

1- Transfer of title means change of ownership.(SOG)

Mere transfer of custody or possession over goods or immovable property where ownership is

not transferred does not amount to transfer of title.

Illustration 1 : Giving the property on rent on or goods for use on hire would not involve a

transfer of title.

Illustration 2 : A car manufacturing company sold 2 cars to M/s P Ltd and the registry of those

trucks is also made in the name of M/s P Ltd. This will constitute transfer of title in goods i.e.

cars and the transaction would be treated as supply of goods.

2- Any transfer of right in goods or of undivided share in goods without the transfer of title

thereof, is a supply of services. (SOS)

Illustration 1 : If car manufacturing gave its 10 cars to M/s P Ltd for carrying out a particular order

and the same are to be returned. This is the case where goods are transferred and not title in the

goods. Hence it is a case of Supply of services.

3- Any transfer of title in goods under an agreement which stipulates that property in goods

will pass at a future date upon payment of full consideration as agreed, is a supply of

goods. (SOG)

Illustration 1 : If car manufacturing company gave its 10 cars to M/s P ltd on the condition that

payment for the same would be made in 10 installments as per agreement and upon payment in full

title of cars would be passed on.

4- Any lease, tenancy, easement, licence to occupy land is a supply of services. (SOS)

Lease : means a legal agreement by which money is paid in order to use land, building, plant or

vehicle for an agreed period of time.

Tenancy :A contract by which the owner of real property grants possession of that property to

another in exchange for periodic payment of money.

Easement : The right to use the real property of another for a specific purpose. The easement is

itself a real property interest, but legal title to the underlying land is retained by the original owner

for all other purposes.

License : An official document from an authority, court etc that gives you permission to do, have

or own something.

5- Any lease or letting out of the building including a commercial, industrial or residential

complex for business or commerce, either wholly or partly, is a supply of services. (SOS)

Illustration 1 : XYZ gives its commercial building to ABC ltd for commercial purposes. This is

the case of leasing of building and covered as supply of services.

6- Any treatment or process which is being applied to another person’s goods is a supply of

services. (SOS)

Illustration 1 : X Ltd recd diamonds from B Ltd for shaping in desired size and shape. This is

process applied to another person’s goods and it is a case of Supply of service.

7- Where goods forming part of the assets of a business are transferred or disposed of by or

under the directions of the person carrying on the business so as no longer to form part

of those assets, whether or not for a consideration, such transfer or disposal is a supply of

goods by the person. (SOG)

8- Where, by or under the direction of a person carrying on a business, goods held or used

for the purposes of the business are put to any private use or are used, or made available

to any person for use, for any purpose other than a purpose of the business, whether or

not for a consideration, the usage or making available of such goods is a supply of

services.(SOS) Page10

Illustration 1 : A car was provided by company to its director which is used by him for office and

Central Goods & Services Tax Act, 2017