Page 150 - CA Final GST

P. 150

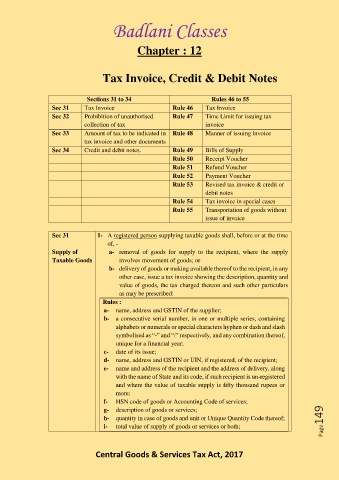

Badlani Classes

Chapter : 12

Tax Invoice, Credit & Debit Notes

Sections 31 to 34 Rules 46 to 55

Sec 31 Tax Invoice Rule 46 Tax Invoice

Sec 32 Prohibition of unauthorised Rule 47 Time Limit for issuing tax

collection of tax invoice

Sec 33 Amount of tax to be indicated in Rule 48 Manner of issuing invoice

tax invoice and other documents

Sec 34 Credit and debit notes. Rule 49 Bills of Supply

Rule 50 Receipt Voucher

Rule 51 Refund Voucher

Rule 52 Payment Voucher

Rule 53 Revised tax invoice & credit or

debit notes

Rule 54 Tax invoice in special cases

Rule 55 Transportation of goods without

issue of invoice

Sec 31 1- A registered person supplying taxable goods shall, before or at the time

of, -

Supply of a- removal of goods for supply to the recipient, where the supply

Taxable Goods involves movement of goods; or

b- delivery of goods or making available thereof to the recipient, in any

other case, issue a tax invoice showing the description, quantity and

value of goods, the tax charged thereon and such other particulars

as may be prescribed:

Rules :

a- name, address and GSTIN of the supplier;

b- a consecutive serial number, in one or multiple series, containing

alphabets or numerals or special characters hyphen or dash and slash

symbolised as “-” and “/” respectively, and any combination thereof,

unique for a financial year;

c- date of its issue;

d- name, address and GSTIN or UIN, if registered, of the recipient;

e- name and address of the recipient and the address of delivery, along

with the name of State and its code, if such recipient is un-registered

and where the value of taxable supply is fifty thousand rupees or

more;

f- HSN code of goods or Accounting Code of services;

g- description of goods or services;

h- quantity in case of goods and unit or Unique Quantity Code thereof; Page149

i- total value of supply of goods or services or both;

Central Goods & Services Tax Act, 2017