Page 177 - CA Final GST

P. 177

Badlani Classes

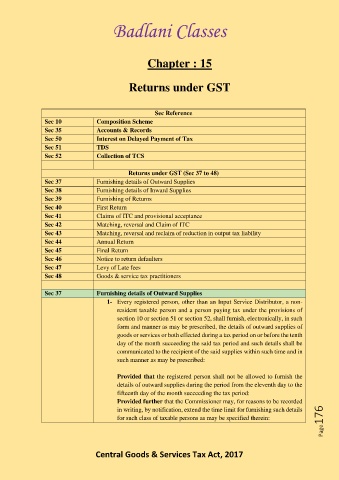

Chapter : 15

Returns under GST

Sec Reference

Sec 10 Composition Scheme

Sec 35 Accounts & Records

Sec 50 Interest on Delayed Payment of Tax

Sec 51 TDS

Sec 52 Collection of TCS

Returns under GST (Sec 37 to 48)

Sec 37 Furnishing details of Outward Supplies

Sec 38 Furnishing details of Inward Supplies

Sec 39 Furnishing of Returns

Sec 40 First Return

Sec 41 Claims of ITC and provisional acceptance

Sec 42 Matching, reversal and Claim of ITC

Sec 43 Matching, reversal and reclaim of reduction in output tax liability

Sec 44 Annual Return

Sec 45 Final Return

Sec 46 Notice to return defaulters

Sec 47 Levy of Late fees

Sec 48 Goods & service tax practitioners

Sec 37 Furnishing details of Outward Supplies

1- Every registered person, other than an Input Service Distributor, a non-

resident taxable person and a person paying tax under the provisions of

section 10 or section 51 or section 52, shall furnish, electronically, in such

form and manner as may be prescribed, the details of outward supplies of

goods or services or both effected during a tax period on or before the tenth

day of the month succeeding the said tax period and such details shall be

communicated to the recipient of the said supplies within such time and in

such manner as may be prescribed:

Provided that the registered person shall not be allowed to furnish the

details of outward supplies during the period from the eleventh day to the

fifteenth day of the month succeeding the tax period:

Provided further that the Commissioner may, for reasons to be recorded

Page176

in writing, by notification, extend the time limit for furnishing such details

for such class of taxable persons as may be specified therein:

Central Goods & Services Tax Act, 2017