Page 22 - CA Final GST

P. 22

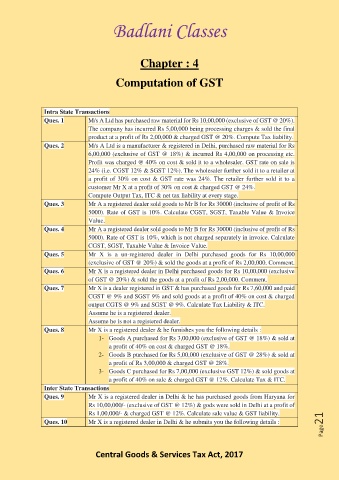

Badlani Classes

Chapter : 4

Computation of GST

Intra State Transactions

Ques. 1 M/s A Ltd has purchased raw material for Rs 10,00,000 (exclusive of GST @ 20%).

The company has incurred Rs 5,00,000 being processing charges & sold the final

product at a profit of Rs 2,00,000 & charged GST @ 20%. Compute Tax liability.

Ques. 2 M/s A Ltd is a manufacturer & registered in Delhi, purchased raw material for Rs

6,00,000 (exclusive of GST @ 18%) & incurred Rs 4,00,000 on processing etc.

Profit was charged @ 40% on cost & sold it to a wholesaler. GST rate on sale is

24% (i.e. CGST 12% & SGST 12%). The wholesaler further sold it to a retailer at

a profit of 30% on cost & GST rate was 24%. The retailer further sold it to a

customer Mr X at a profit of 30% on cost & charged GST @ 24%.

Compute Output Tax, ITC & net tax liability at every stage.

Ques. 3 Mr A a registered dealer sold goods to Mr B for Rs 30000 (inclusive of profit of Rs

5000). Rate of GST is 10%. Calculate CGST, SGST, Taxable Value & Invoice

Value.

Ques. 4 Mr A a registered dealer sold goods to Mr B for Rs 30000 (inclusive of profit of Rs

5000). Rate of GST is 10%, which is not charged separately in invoice. Calculate

CGST, SGST, Taxable Value & Invoice Value.

Ques. 5 Mr X is a un-registered dealer in Delhi purchased goods for Rs 10,00,000

(exclusive of GST @ 20%) & sold the goods at a profit of Rs 2,00,000. Comment.

Ques. 6 Mr X is a registered dealer in Delhi purchased goods for Rs 10,00,000 (exclusive

of GST @ 20%) & sold the goods at a profit of Rs 2,00,000. Comment.

Ques. 7 Mr X is a dealer registered in GST & has purchased goods for Rs 7,60,000 and paid

CGST @ 9% and SGST 9% and sold goods at a profit of 40% on cost & charged

output CGTS @ 9% and SGST @ 9%. Calculate Tax Liability & ITC.

Assume he is a registered dealer.

Assume he is not a registered dealer.

Ques. 8 Mr X is a registered dealer & he furnishes you the following details :

1- Goods A purchased for Rs 3,00,000 (exclusive of GST @ 18%) & sold at

a profit of 40% on cost & charged GST @ 18%.

2- Goods B purchased for Rs 5,00,000 (exclusive of GST @ 28%) & sold at

a profit of Rs 3,00,000 & charged GST @ 28%.

3- Goods C purchased for Rs 7,00,000 (exclusive GST 12%) & sold goods at

a profit of 40% on sale & charged GST @ 12%. Calculate Tax & ITC.

Inter State Transactions

Ques. 9 Mr X is a registered dealer in Delhi & he has purchased goods from Haryana for

Rs 10,00,000/- (exclusive of GST @ 12%) & gods were sold in Delhi at a profit of

Page21

Rs 1,00,000/- & charged GST @ 12%. Calculate sale value & GST liability.

Ques. 10 Mr X is a registered dealer in Delhi & he submits you the following details :

Central Goods & Services Tax Act, 2017