Page 56 - CA Final GST

P. 56

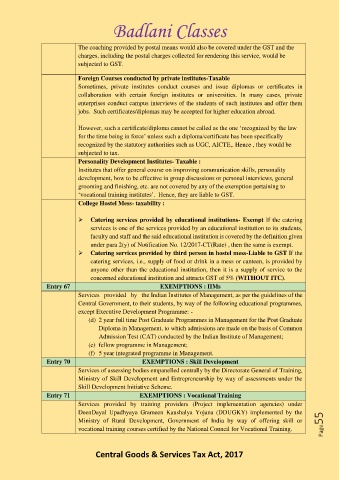

Badlani Classes

The coaching provided by postal means would also be covered under the GST and the

charges, including the postal charges collected for rendering this service, would be

subjected to GST.

Foreign Courses conducted by private institutes-Taxable

Sometimes, private institutes conduct courses and issue diplomas or certificates in

collaboration with certain foreign institutes or universities. In many cases, private

enterprises conduct campus interviews of the students of such institutes and offer them

jobs. Such certificates/diplomas may be accepted for higher education abroad.

However, such a certificate/diploma cannot be called as the one ‘recognized by the law

for the time being in force’ unless such a diploma/certificate has been specifically

recognized by the statutory authorities such as UGC, AICTE,. Hence , they would be

subjected to tax.

Personality Development Institutes- Taxable :

Institutes that offer general course on improving communication skills, personality

development, how to be effective in group discussions or personal interviews, general

grooming and finishing, etc. are not covered by any of the exemption pertaining to

‘vocational training institutes’. Hence, they are liable to GST.

College Hostel Mess- taxability :

➢ Catering services provided by educational institutions- Exempt If the catering

services is one of the services provided by an educational institution to its students,

faculty and staff and the said educational institution is covered by the definition given

under para 2(y) of Notification No. 12/2017-CT(Rate) , then the same is exempt.

➢ Catering services provided by third person in hostel mess-Liable to GST If the

catering services, i.e., supply of food or drink in a mess or canteen, is provided by

anyone other than the educational institution, then it is a supply of service to the

concerned educational institution and attracts GST of 5% (WITHOUT ITC).

Entry 67 EXEMPTIONS : IIMs

Services provided by the Indian Institutes of Management, as per the guidelines of the

Central Government, to their students, by way of the following educational programmes,

except Executive Development Programme: -

(d) 2 year full time Post Graduate Programmes in Management for the Post Graduate

Diploma in Management, to which admissions are made on the basis of Common

Admission Test (CAT) conducted by the Indian Institute of Management;

(e) fellow programme in Management;

(f) 5 year integrated programme in Management.

Entry 70 EXEMPTIONS : Skill Development

Services of assessing bodies empanelled centrally by the Directorate General of Training,

Ministry of Skill Development and Entrepreneurship by way of assessments under the

Skill Development Initiative Scheme.

Entry 71 EXEMPTIONS : Vocational Training

Services provided by training providers (Project implementation agencies) under

DeenDayal Upadhyaya Grameen Kaushalya Yojana (DDUGKY) implemented by the

Ministry of Rural Development, Government of India by way of offering skill or Page55

vocational training courses certified by the National Council for Vocational Training.

Central Goods & Services Tax Act, 2017