Page 58 - Phelan Energy Green Ammonia Plant Egypt

P. 58

Financing Plan – Project Costs & Funding

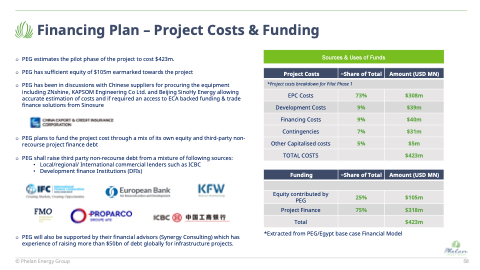

o PEG estimates the pilot phase of the project to cost $423m.

o PEG has sufficient equity of $105m earmarked towards the project

o PEG has been in discussions with Chinese suppliers for procuring the equipment including ZNshine, KAPSOM Engineering Co Ltd. and Beijing SinoHy Energy allowing

accurate estimation of costs and if required an access to ECA backed funding & trade finance solutions from Sinosure

o PEG plans to fund the project cost through a mix of its own equity and third-party non- recourse project finance debt

o PEG shall raise third party non-recourse debt from a mixture of following sources:

• Local/regional/ International commercial lenders such as ICBC

• Development finance Institutions (DFIs)

Sources & Uses of Funds

Project Costs

~Share of Total

Amount (USD MN)

*Project costs breakdown for Pilot Phase 1

EPC Costs

73%

$308m

Development Costs

9%

$39m

Financing Costs

9%

$40m

Contingencies

7%

$31m

Other Capitalised costs

5%

$5m

TOTAL COSTS

$423m

Funding

~Share of Total

Amount (USD MN)

Equity contributed by PEG

25%

$105m

Project Finance

75%

$318m

Total

$423m

o PEG will also be supported by their financial advisors (Synergy Consulting) which has experience of raising more than $50bn of debt globally for infrastructure projects.

*Extracted from PEG/Egypt base case Financial Model

© Phelan Energy Group

58