Page 60 - Phelan Energy Green Ammonia Plant Egypt

P. 60

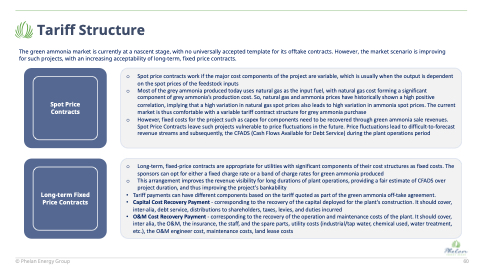

Tariff Structure

The green ammonia market is currently at a nascent stage, with no universally accepted template for its offtake contracts. However, the market scenario is improving for such projects, with an increasing acceptability of long-term, fixed price contracts.

Spot Price Contracts

o Spot price contracts work if the major cost components of the project are variable, which is usually when the output is dependent on the spot prices of the feedstock inputs

o Most of the grey ammonia produced today uses natural gas as the input fuel, with natural gas cost forming a significant component of grey ammonia’s production cost. So, natural gas and ammonia prices have historically shown a high positive correlation, implying that a high variation in natural gas spot prices also leads to high variation in ammonia spot prices. The current market is thus comfortable with a variable tariff contract structure for grey ammonia purchase

o However, fixed costs for the project such as capex for components need to be recovered through green ammonia sale revenues. Spot Price Contracts leave such projects vulnerable to price fluctuations in the future. Price fluctuations lead to difficult-to-forecast revenue streams and subsequently, the CFADS (Cash Flows Available for Debt Service) during the plant operations period

o Long-term, fixed-price contracts are appropriate for utilities with significant components of their cost structures as fixed costs. The sponsors can opt for either a fixed charge rate or a band of charge rates for green ammonia produced

o This arrangement improves the revenue visibility for long durations of plant operations, providing a fair estimate of CFADS over project duration, and thus improving the project's bankability

• Tariff payments can have different components based on the tariff quoted as part of the green ammonia off-take agreement.

• Capital Cost Recovery Payment - corresponding to the recovery of the capital deployed for the plant's construction. It should cover,

inter-alia, debt service, distributions to shareholders, taxes, levies, and duties incurred

• O&M Cost Recovery Payment - corresponding to the recovery of the operation and maintenance costs of the plant. It should cover,

inter alia, the O&M, the insurance, the staff, and the spare parts, utility costs (industrial/tap water, chemical used, water treatment, etc.), the O&M engineer cost, maintenance costs, land lease costs

Long-term Fixed Price Contracts

© Phelan Energy Group

60