Page 62 - Phelan Energy Green Ammonia Plant Egypt

P. 62

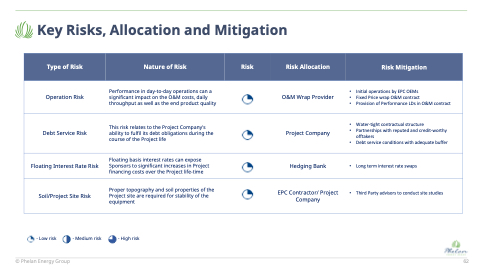

Key Risks, Allocation and Mitigation

Type of Risk Nature of Risk Risk Risk Allocation Risk Mitigation

Performance in day-to-day operations can a Operation Risk significant impact on the O&M costs, daily

throughput as well as the end product quality

O&M Wrap Provider

• Initial operations by EPC OEMs

• Fixed Price wrap O&M contract

• Provision of Performance LDs in O&M contract

Debt Service Risk

This risk relates to the Project Company's ability to fulfil its debt obligations during the course of the Project life

Project Company

• Water-tight contractual structure

• Partnerships with reputed and credit-worthy

offtakers

• Debt service conditions with adequate buffer

Floating basis interest rates can expose

Floating Interest Rate Risk Sponsors to significant increases in Project Hedging Bank • Long term interest rate swaps

financing costs over the Project life-time

Proper topography and soil properties of the Soil/Project Site Risk Project site are required for stability of the

equipment

EPC Contractor/ Project • Third Party advisors to conduct site studies Company

- Low risk - Medium risk - High risk © Phelan Energy Group

62