Page 8 - A

P. 8

Structural change – disintermediation

of the retail banking value chain

The widespread consumption of digital banking services by technologically

savvy, less loyal customers and the rise of non-traditional players, combined

with the high costs of operation of incumbent banks, will eventually lead

to removal of end-to-end manufacturing and distribution entirely within a

bank. Anthony Jenkins, the former CEO of Barclays, recently said, “Large

banks will fragment as they seek to protect the profitable parts of their

operations.”

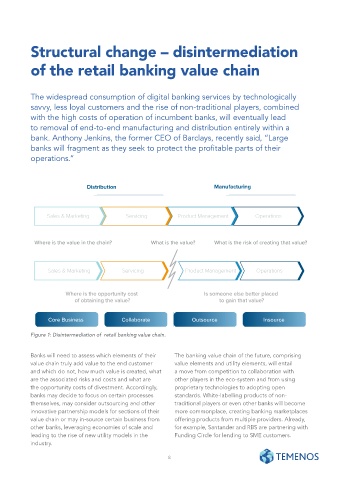

Distribution Manufacturing

Sales & Marketing Servicing Product Management Operations

Where is the value in the chain? What is the value? What is the risk of creating that value?

Sales & Marketing Servicing Product Management Operations

Where is the opportunity cost Is someone else better placed

of obtaining the value? to gain that value?

Core Business Collaborate Outsource Insource

Figure 1: Disintermediation of retail banking value chain.

Banks will need to assess which elements of their The banking value chain of the future, comprising

value chain truly add value to the end customer value elements and utility elements, will entail

and which do not, how much value is created, what a move from competition to collaboration with

are the associated risks and costs and what are other players in the eco-system and from using

the opportunity costs of divestment. Accordingly, proprietary technologies to adopting open

banks may decide to focus on certain processes standards. White-labelling products of non-

themselves, may consider outsourcing and other traditional players or even other banks will become

innovative partnership models for sections of their more commonplace, creating banking marketplaces

value chain or may in-source certain business from offering products from multiple providers. Already,

other banks, leveraging economies of scale and for example, Santander and RBS are partnering with

leading to the rise of new utility models in the Funding Circle for lending to SME customers.

industry.

8