Page 45 - Agib Bank Limited Annual Report 2021

P. 45

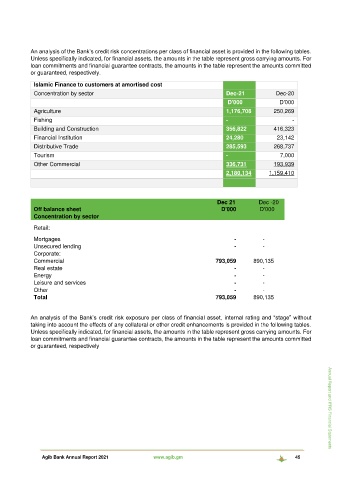

An analysis of the Bank’s credit risk concentrations per class of financial asset is provided in the following tables.

Unless specifically indicated, for financial assets, the amounts in the table represent gross carrying amounts. For

loan commitments and financial guarantee contracts, the amounts in the table represent the amounts committed

or guaranteed, respectively.

Islamic Finance to customers at amortised cost

Concentration by sector Dec-21 Dec-20

D'000 D'000

Agriculture 1,176,708 250,269

Fishing - -

Building and Construction 356,822 416,323

Financial Institution 24,280 23,142

Distributive Trade 285,593 268,737

Tourism - 7,000

Other Commercial 336,731 193,939

2,180,134 1,159,410

Dec 21 Dec -20

Off balance sheet D'000 D'000

Concentration by sector

Retail:

Mortgages - -

Unsecured lending - -

Corporate:

Commercial 793,059 890,135

Real estate - -

Energy - -

Leisure and services - -

Other - -

Total 793,059 890,135

An analysis of the Bank’s credit risk exposure per class of financial asset, internal rating and “stage” without

taking into account the effects of any collateral or other credit enhancements is provided in the following tables.

Unless specifically indicated, for financial assets, the amounts in the table represent gross carrying amounts. For

loan commitments and financial guarantee contracts, the amounts in the table represent the amounts committed

or guaranteed, respectively

Annual Report and IFRS Financial Statements

Agib Bank Annual Report 2021 www.agib.gm 45