Page 66 - Agib Bank Limited Annual Report 2021

P. 66

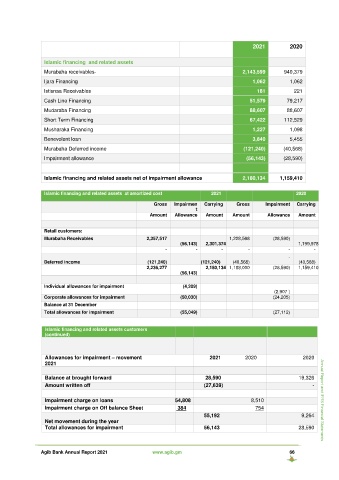

2021 2020

Islamic financing and related assets

Murabaha receivables- 2,143,599 940,379

Ijara Financing 1,062 1,062

Istisnaa Receivables 181 221

Cash Line Financing 51,579 79,217

Mudaraba Financing 88,607 88,607

Short Term Financing 67,422 112,529

Musharaka Financing 1,227 1,098

Benevolent loan 3,840 5,455

Murabaha Deferred income (121,240) (40,568)

Impairment allowance (56,143) (28,590)

Islamic financing and related assets net of impairment allowance 2,180,134 1,159,410

Islamic financing and related assets at amortized cost 2021 2020

Gross Impairmen Carrying Gross Impairment Carrying

t

Amount Allowance Amount Amount Allowance Amount

Retail customers:

Murabaha Receivables 2,357,517 1,228,568 (28,590)

(56,143) 2,301,374 1,199,978

- - - - - -

-

Deferred income (121,240) (121,240) (40,568) (40,568)

2,236,277 2,180,134 1,188,000 (28,590) 1,159,410

(56,143)

Individual allowances for impairment (4,209)

(2,907 )

Corporate allowances for impairment (50,030) (24,205)

Balance at 31 December

Total allowances for impairment (55,049) (27,112)

Islamic financing and related assets customers

(continued)

Allowances for impairment – movement 2021 2020 2020

2021

Balance at brought forward 28,590 19,326

Amount written off (27,639) -

Impairment charge on loans 54,808 8,510 Annual Report and IFRS Financial Statements

Impairment charge on Off balance Sheet 384 754

55,192 9,264

Net movement during the year

Total allowances for impairment 56,143 28,590

Agib Bank Annual Report 2021 www.agib.gm 66