Page 72 - Agib Bank Limited Annual Report 2021

P. 72

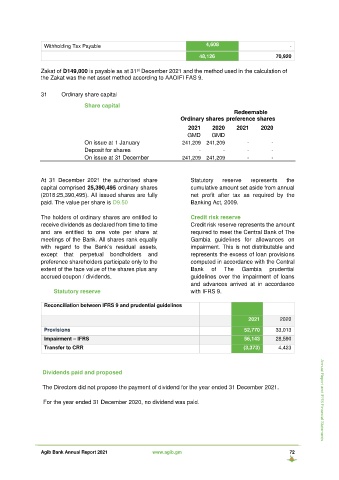

Withholding Tax Payable 4,608 -

48,126 70,920

Zakat of D149,000 is payable as at 31 December 2021 and the method used in the calculation of

st

the Zakat was the net asset method according to AAOIFI FAS 9.

31 Ordinary share capital

Share capital

Redeemable

Ordinary shares preference shares

2021 2020 2021 2020

GMD GMD

On issue at 1 January 241,209 241,209 - -

Deposit for shares - - - -

On issue at 31 December 241,209 241,209 - -

At 31 December 2021 the authorised share Statutory reserve represents the

capital comprised 25,390,495 ordinary shares cumulative amount set aside from annual

(2018:25,390,495). All issued shares are fully net profit after tax as required by the

paid. The value per share is D9.50 Banking Act, 2009.

The holders of ordinary shares are entitled to Credit risk reserve

receive dividends as declared from time to time Credit risk reserve represents the amount

and are entitled to one vote per share at required to meet the Central Bank of The

meetings of the Bank. All shares rank equally Gambia guidelines for allowances on

with regard to the Bank’s residual assets, impairment. This is not distributable and

except that perpetual bondholders and represents the excess of loan provisions

preference shareholders participate only to the computed in accordance with the Central

extent of the face value of the shares plus any Bank of The Gambia prudential

accrued coupon / dividends. guidelines over the impairment of loans

and advances arrived at in accordance

Statutory reserve with IFRS 9.

Reconciliation between IFRS 9 and prudential guidelines

2021 2020

Provisions 52,770 33,013

Impairment – IFRS 56,143 28,590

Transfer to CRR (3,373) 4,423

Dividends paid and proposed

The Directors did not propose the payment of dividend for the year ended 31 December 2021.

For the year ended 31 December 2020, no dividend was paid. Annual Report and IFRS Financial Statements

Agib Bank Annual Report 2021 www.agib.gm 72