Page 18 - Mathematics of Business and Finance

P. 18

xviii Updates

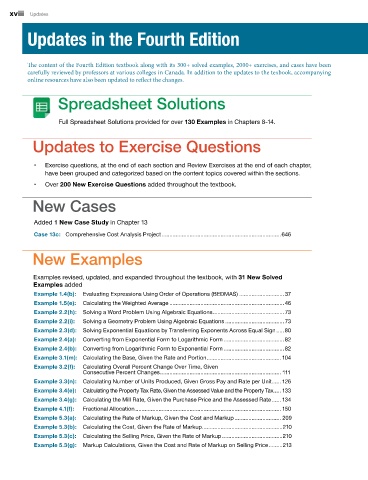

Updates in the Fourth Edition

The content of the Fourth Edition textbook along with its 300+ solved examples, 2000+ exercises, and cases have been

carefully reviewed by professors at various colleges in Canada. In addition to the updates to the texbook, accompanying

online resources have also been updated to reflect the changes.

Spreadsheet Solutions

Full Spreadsheet Solutions provided for over 130 Examples in Chapters 8-14.

Updates to Exercise Questions

• Exercise questions, at the end of each section and Review Exercises at the end of each chapter,

have been grouped and categorized based on the content topics covered within the sections.

• Over 200 New Exercise Questions added throughout the textbook.

New Cases

Added 1 New Case Study in Chapter 13

Case 13c: Comprehensive Cost Analysis Project .............................................................................646

New Examples

Examples revised, updated, and expanded throughout the textbook, with 31 New Solved

Examples added

Example 1.4(b): Evaluating Expressions Using Order of Operations (BEDMAS) .............................37

Example 1.5(e): Calculating the Weighted Average ..........................................................................46

Example 2.2(h): Solving a Word Problem Using Algebraic Equations ..............................................73

Example 2.2(i): Solving a Geometry Problem Using Algebraic Equations ......................................73

Example 2.3(d): Solving Exponential Equations by Transferring Exponents Across Equal Sign .....80

Example 2.4(a): Converting from Exponential Form to Logarithmic Form .......................................82

Example 2.4(b): Converting from Logarithmic Form to Exponential Form .......................................82

Example 3.1(m): Calculating the Base, Given the Rate and Portion ................................................ 104

Example 3.2(f): Calculating Overall Percent Change Over Time, Given

Consecutive Percent Changes .............................................................................. 111

Example 3.3(n): Calculating Number of Units Produced, Given Gross Pay and Rate per Unit ...... 126

Example 3.4(e): Calculating the Property Tax Rate, Given the Assessed Value and the Property Tax..... 133

Example 3.4(g): Calculating the Mill Rate, Given the Purchase Price and the Assessed Rate ...... 134

Example 4.1(f): Fractional Allocation .............................................................................................. 150

Example 5.3(a): Calculating the Rate of Markup, Given the Cost and Markup .............................. 209

Example 5.3(b): Calculating the Cost, Given the Rate of Markup ....................................................210

Example 5.3(c): Calculating the Selling Price, Given the Rate of Markup .......................................210

Example 5.3(g): Markup Calculations, Given the Cost and Rate of Markup on Selling Price .........213