Page 14 - Demo

P. 14

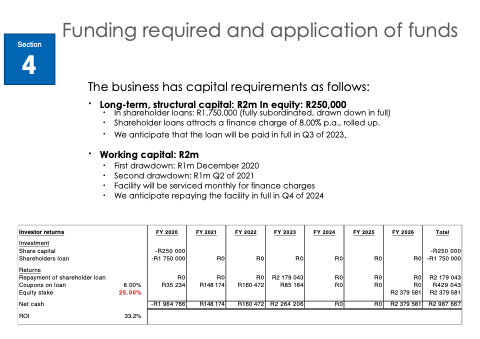

Funding required and application of funds

The business has capital requirements as follows:

Section

4

•

•

•

•

In shareholder loans: R1,750,000 (fully subordinated, drawn down in full) Shareholder loans attracts a finance charge of 8.00% p.a., rolled up.

We anticipate that the loan will be paid in full in Q3 of 2023.

•

Working capital: R2m

Long-term, structural capital: R2m In equity: R250,000

•

•

•

•

First drawdown: R1m December 2020

Second drawdown: R1m Q2 of 2021

Facility will be serviced monthly for finance charges We anticipate repaying the facility in full in Q4 of 2024

0123456

Investor returns

Investment

Share capital Shareholders loan

Returns

Repayment of shareholder loan Coupons on loan

Equity stake

Net cash ROI

8.00%

25.00%

33.2%

FY 2020

-R250 000 -R1 750 000

R0 R35 234

FY 2021

R0

R0 R148 174

FY 2022

R0

R0 R160 472

FY 2023

R0

R2 179 043 R85 164

FY 2024

R0

R0 R0

FY 2025

R0

R0 R0

FY 2026

R0

R0

R0 R2 379 581

Total

-R250 000 -R1 750 000

R2 179 043 R429 043 R2 379 581

-R1 964 766

R148 174

R160 472

R2 264 206

R0

R0

R2 379 581

R2 987 667